Products You May Like

- Dow Jones remains stubbornly flat in quiet Thursday trading.

- Stocks, bonds, and currencies all go flat as markets await key US data.

- Friday’s NFP to go a long way in confirming market rate cut outlook.

The Down Jones Industrial Average (DJIA) stuck firmly to midrange bets on Thursday as investors knuckle down for the wait to Friday’s US Nonfarm Payrolls (NFP) print. Investors are holding onto hopes for two rate cuts this year from the Federal Reserve (Fed) with the first expected in September. Continued easing in US data will help to confirm a softening economy, increasing the chances that the Fed will get pushed towards a faster pace of rate cuts.

US Initial Jobless Claims rose to 229K for the week ended May 31, jumping over the forecast 220K and the revised previous figure of 221K.

Friday’s US NFP is expected to show 185K net job additions in May, a step higher than the previous month’s 175K. Markets will also keep an eye out for any steep revisions to previous releases.

Dow Jones news

About two-thirds of the Dow Jones index is finding gains on Thursday, but declines in key major equities are keeping bullish momentum hobbled. Intel Corp. (INTC) and Unitedhealth Group Inc. (UNH) are both down around 1% on the day, testing $30.49 and $498.87 per share, respectively. On the high side, Salesforce Inc. (CRM) and Nike Inc (NKE) are both up over 2% during the US market session. CRM is testing back over $240.00 per share while Nike is approaching $100.00 per share.

Dow Jones technicals

The Dow Jones is up around 60 points on Thursday, trading within a fifth of a percent from the day’s opening bids. Buyers have been struggling to haul bids back over the 39,000.00 handle, but the major equity index has recover from a near-term dip to 38,000.00.

The DJIA is still down -3% from all-time peaks above 40,000.00 set in May, but a long-term demand zone from 38,000.00 to 37,500.00 is keeping prices bolstered.

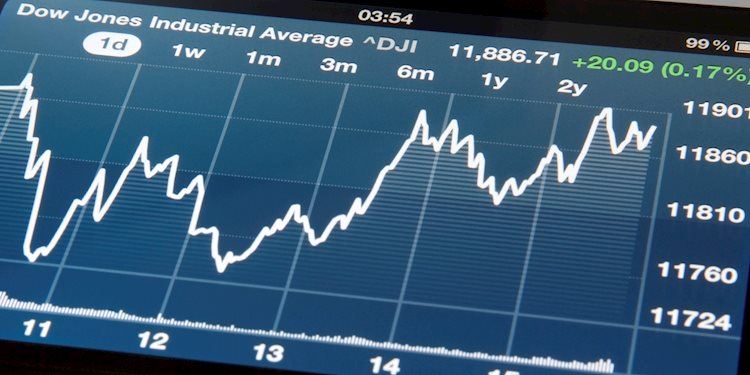

Dow Jones five minute chart

Dow Jones daily chart

Economic Indicator

Initial Jobless Claims

The Initial Jobless Claims released by the US Department of Labor is a measure of the number of people filing first-time claims for state unemployment insurance. A larger-than-expected number indicates weakness in the US labor market, reflects negatively on the US economy, and is negative for the US Dollar (USD). On the other hand, a decreasing number should be taken as bullish for the USD.

Last release: Thu Jun 06, 2024 12:30

Frequency: Weekly

Actual: 229K

Consensus: 220K

Previous: 219K

Source: US Department of Labor