Products You May Like

- Bitcoin price has breached $64,000 threshold as trading volume rises by over 15%.

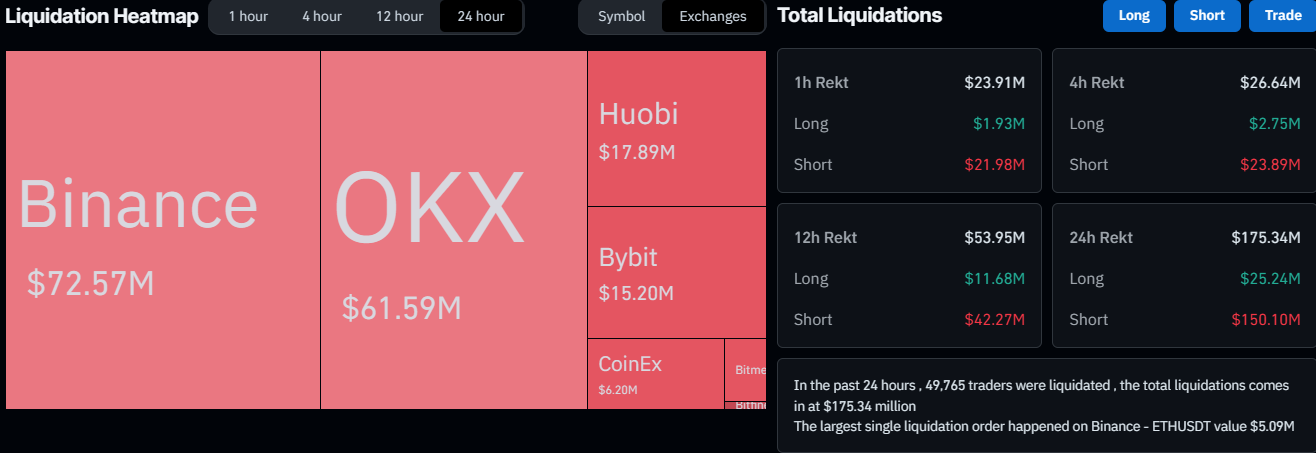

- Total liquidations went passed $175 million as more than $150 million shorts were blown out of water.

- Binance saw most liquidations with largest single liquidation order being $5.09 million for ETH/USDT trading pair.

Bitcoin (BTC) price shattered the $64,000 threshold on Saturday, May 4, recording an intra-day high of $64,540 as of 11:30 a.m. GMT. Trading volume is up by over 15% despite expected weekend lull when traders take time off.

Millions in liquidations as Bitcoin price reclaims $64,000

In the aftermath of Bitcoin price shattering the $64,000 threshold, over $175 million in total liquidations was recorded in the cryptocurrency market. Out of these, $150.10 million comprise short positions while over $25 million longs were rekt.

Total liquidations

Binance exchange, the largest platform by trading volume metrics recorded the most liquidations at $72.57 million, followed by OKX at $61.59 million. The largest single liquidation order was witnessed on Binance, where up to $5.09 million went down the drain for the Ethereum trading pair against Tether (USDT) stablecoin.

Interestingly, the move saw Bitcoin price break above month-long trendline that acted as resistance. With the breakout pending confirmation, traders looking to long BTC should exercise caution because of expected weekend volatility.

Let’s see if King #Bitcoin can continue UP☝

— Dominic Frei (Freistyle Bali Crypto) (@Freistyle_Bali) May 4, 2024

At the time of writing, Bitcoin price is trading for $63,781.

BTC/USDT 1-day chart