Products You May Like

Continues the retracement lower

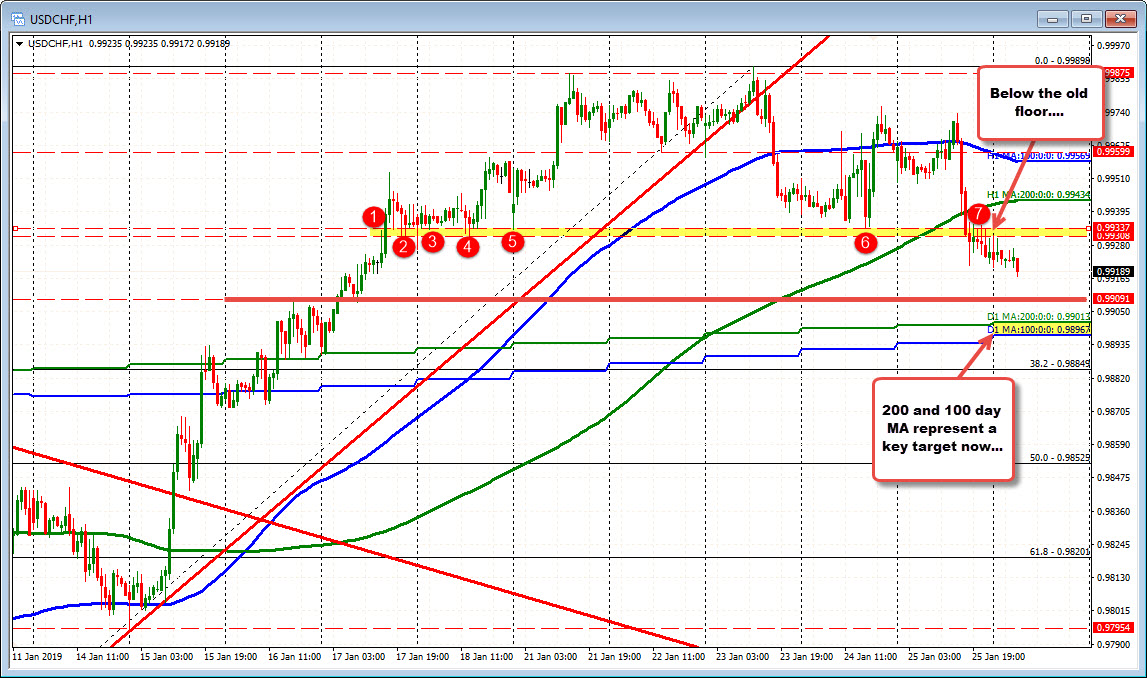

The USDCHF has moved to new session lows on the day and trades at the lowest level since January 17th. The pair last week stalled just below the parity level (high reached 0.9987 and 0.9989). On Friday, the price ran below the 200 hour MA for the first time since January 15. That MA comes in at 0.99434.

Looking at the hourly chart, the price moved below the 0.9931-34 area which was acting as a floor and is close risk for shorts now. The high today reached 0.99315. Stay below keeps the sellers more in control. A move above and we should see a retest of the 200 hour MA. Sellers are taking more control below the MAs and floor.

On the downside, the 0.9909 level is a target. Below that, the 0.98967 to 0.99013 are where the 200 and 100 day MAs are found. Moves below those longer term moving averages should be a tough nut to crack on the first break.