Products You May Like

…and China/US talks

The partial government shutdown is over (at least until Feb 15). Which means at some point we will start getting the backlog of data releases missed. Of course those that calculate the numbers will have a backlog of work to catch up. Nevertheless, the calendar of releases may get very busy this week. Stay tuned.

Regardless of that missed data and uncertainty about when the releases will be released, this week will have some key events and releases that are known with certainty including:

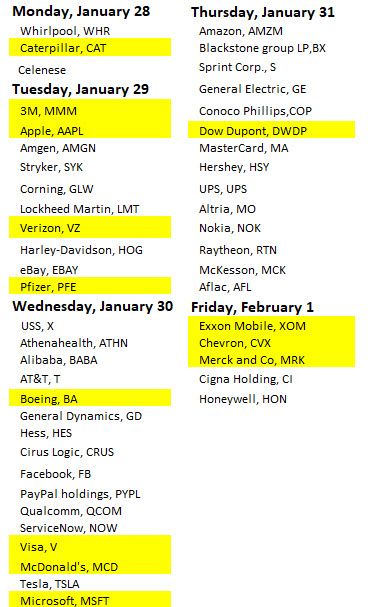

Corporate earnings:

This week will be the biggest week in the earnings calendar cycle. Apple, Verizon, Pfizer are on Tuesday. Boeing, Facebook, Microsoft, PayPal, McDonalds, Tesla, on Wednesday. GE, Amazon, Mastercard, DowDupont on Thursday, and Exxon, Chevron Honeywell and Merch on Friday. Below is a list of the major releases. The Dow 30 stocks are outlined in yellow:

Fed Decision:

US Jobs Report:

The US Labor Department has not been one of the agencies shuttered during the shutdown. As a result, the normal US jobs report will be released on its traditional first Friday period at 8:30 AM ET/1330 GMT. The market is looking for 165K rise in NFT after an oversized 312K in December. The unemployment rate is expected to remain at 3.9%. Average hourly earnings are expected at 0.3% MoM/3.2% YoY (last month 0.4% and 3.2% respectively).

US/China Trade Talks in Washington

Chinese Vice Premier Liu He will travel to the US for trade talks on Wednesday and Thursday. The US has give China 90-days to make progress on trade issues. That clock is to expire on March 2. If there is no progress, the administration is expected to increase tariffs on $200B of Chinese goods.

Commerce Secretary Wilbur Ross said last week that the two parties were “miles and miles away” from a deal but later backtracked a bit by saying he expects a trade deal. The market does not expect a miracle from the talks this week.

Brexit clock is also ticking

This week eyes will be on proposed alternativce plans from UK lawmakers regarding Brexit. One may be a delay of the March 29 exit date from the EU. There has been a proposal to extend the date should a deal not be agreed by February 26th.

The clock ticks toward a possible 2nd governement closure on Feb 15

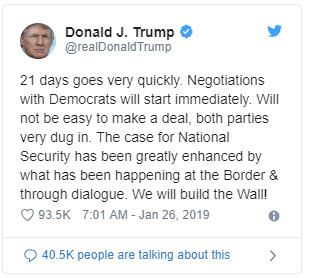

The US government will be back open on Monday, but it is not all rainbows and unicorns. Pres. Trump tweeted over the weekend that “We will build the Wall!”. Dems still don’t want to build the wall.

Tick. Tick. Tick.