Products You May Like

Flash PMI data weak in Europe today

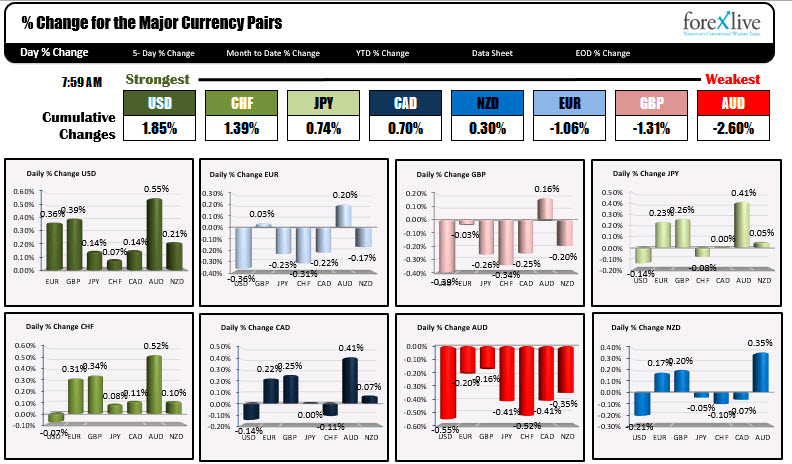

The USD is starting the day as the strongest currency. Flash PMI data out of Europe was weak, helping to send those currencies lower. The AUD is the weakest today. Although employment in Australia showed yet another gain, mortgage rates were increased by NAB and that reversed the currency. The major pairs are relatively close together.

The EURUSD and the GBPUSD pairs are trading near the lows for the day ahead of Draghi and some US data today. Initial claims and Draghi presser is coming above at 8:30 AM ET. Later at 9:45 AM ET, the US Markit PMI will be released followed by Leading index at 10 AM ET. The shut down in the US can’t stop all the data.

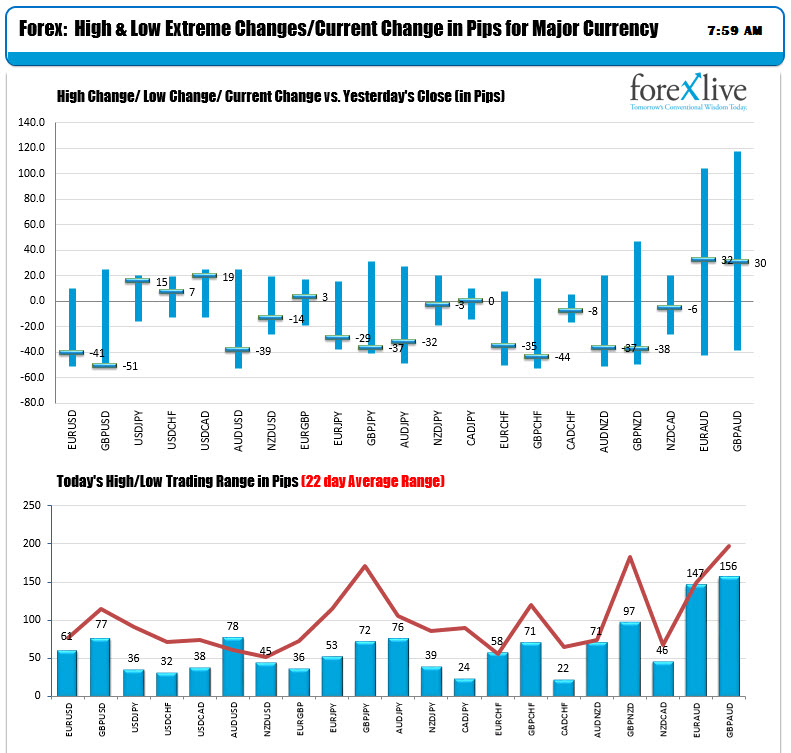

Ranges are limited for most of the currency pairs. The USDJPY, USDCAD and USDCHF are all trading with ranges below 39 pips. The AUDUSD is the biggest pip mover. The GBPUSD is just behind at 78 and 77 pips respectively.

In other markets:

- spot gold is trading down $2.77 or -0.22% at $1279.89

- WTI crude oil futures are trading down $.40 or -0.74% at $52.23

In the pre-trading for US stocks, futures are implying a modestly higher opening:

- Dow Jones, +33.38 points

- S&P index, +5 points

- NASDAQ index, +33 points

In European stock markets, major indices are also higher

- German DAX, +0.42%

- France’s CAC, +0.7%

- UK’s FTSE, unchanged

- Spain’s Ibex, +0.67%

- Italy’s FTSE MIB, +1.0%

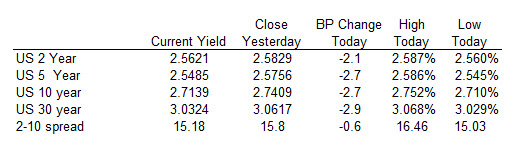

US yields arehe heading lower:

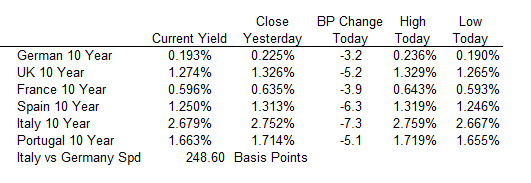

The 10 year benchmark yields in Europe are also trading to the downside after weaker PMI data:

The 10 year benchmark yields in Europe are also trading to the downside after weaker PMI data: