Products You May Like

Commitment of traders report for the week ending September 18, 2018

- EUR long 2K vs 11K long last week. Longs trimmed by 9K

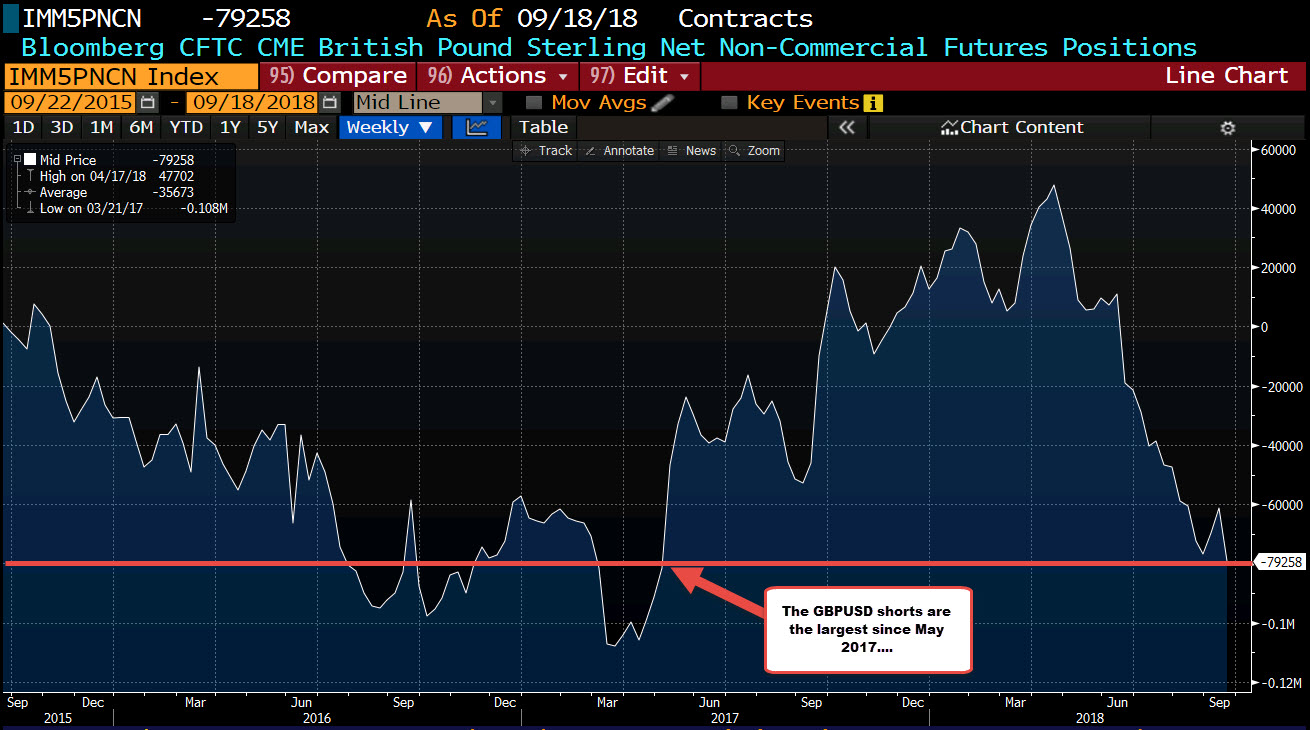

- GBP short 79K vs 61K short last week. Shorts increased by 18K

- JPY short 64K vs 54K short last week. Shorts increased 10K

- CHF short 18K vs 35K short last week. Shorts trimmed 17K

- CAD short 30K vs 27K short last week. Shorts increased 3K

- AUD short 68k vs 44k short last week. Shorts increased by 24K

- NZD short 32K vs 23K short last week. Shorts increased by 9K

- Prior week.

Highlights:

- EUR position moves toward square from long.

- AUD shorts increased by a healthy 24K. The short is the largest since March 2015. The AUDUSD is trading near the week’s highs running counter to the short position

- CHF shorts continued to be trimmed. Since August 21 when the shorts bottomed at -47K. They are now at -18K.

- GBP shorts also increased by a decent amount as traders gear up for Brexit issues. Today those short are looking better than earlier in the week. The short position is at the largest since May 2017.

Viewing

Touch / Click anywhere to close

This article was originally published by Forexlive.com. Read the original article here.