Products You May Like

Technical techniques for following the trend

If you have been

trading for any amount of time, you have likely read about trend following –

which can be used as a forex

trading strategy.

Is it truly the allegorical Holy Grail of trading? Let’s dive deeper into Trend

Following and see if it lives up to the reputation that it has amongst both

novice and experienced Forex traders.

If you are

unfamiliar with Trend Following, it is a system to help predict the direction.

This information is said to assist traders open and close trades more

strategically.

Indicators

Arguably the most

popular way to interpret charts is using Indicators. In very simple terms

indicators are a variety of mathematical price calculations that can

potentially help highlight trends – for example simple moving average (SMA),

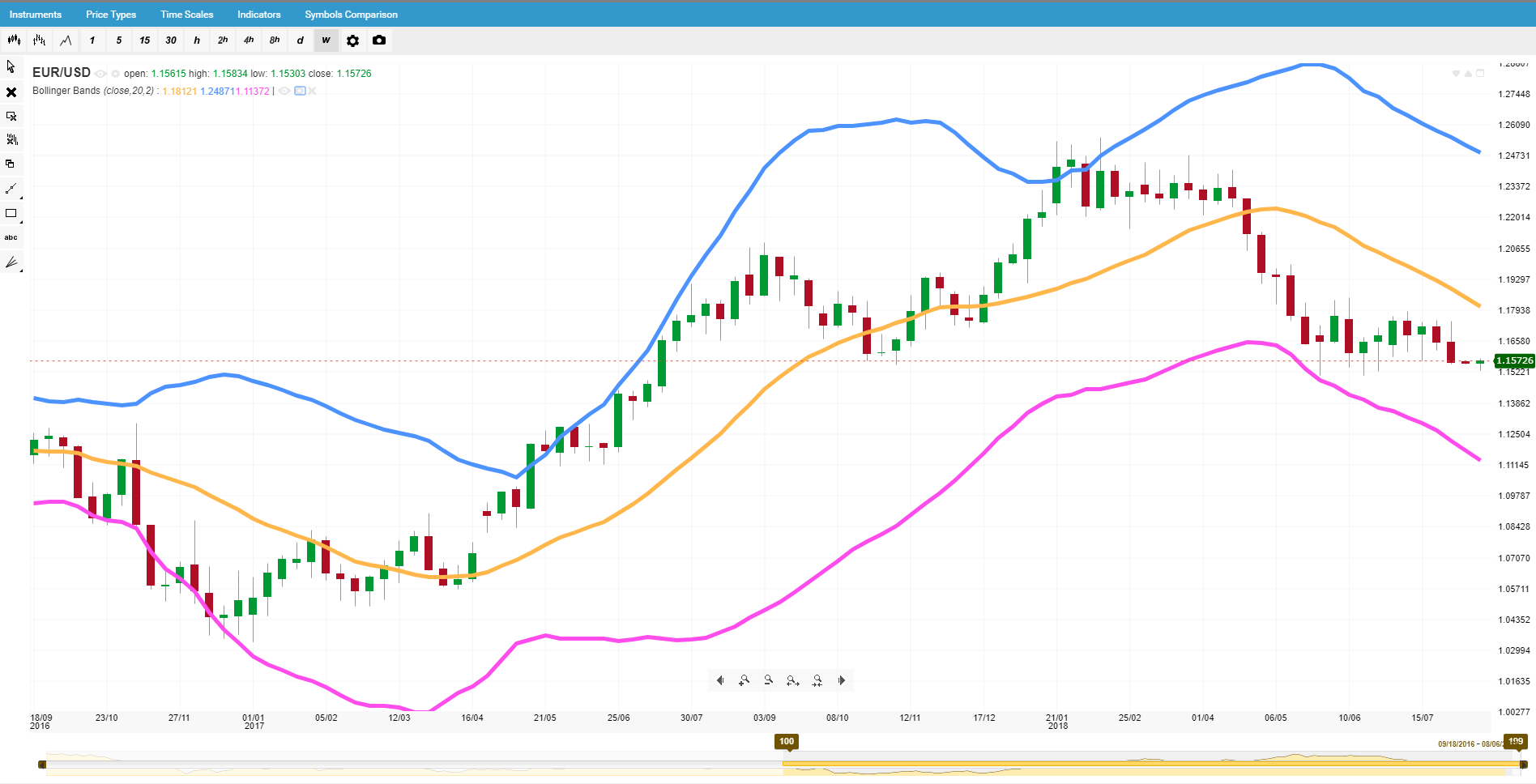

plots the past prices’ arithmetic mean on a line as seen below in the EUR/USD Forex chart.

As you can see

averaging out the prices give a much clearer image of the general movement of

the rate. Small temporary reversals average out and become plotted on a line

that is in a downtrend or uptrend. The calculation can be made across various

timeframes 200, 100 and 50 days.

Extending the

timeframe smooths SMA line whereas

contracting sharpens SMA line.

Another

interesting effect is when the SMA acts as support or resistance – where the

price goes under or approaches the level delineated by the SMA and then returns

above. Here is an example indicated by the circles on the chart below.

Of course, there

are more variations of the Moving Average that involve more sophisticated

calculations that emphasize different moments of the market cycle.

RSI

(Relative Strength Index)

RSI is known as an

oscillator that is indexed between 0 and 100. When the indicator is above 70,

the asset is considered in the overbought region where as if it is under 30 it

is the oversold region. When the instrument is overbought it is consider it

will undergo correction and if it oversold that it will recover.

RSI is probably

not the best indicator to use alone – unlike SMA – because frequently the RSI

will remain above 70 or below 30 for extended periods of time. So, using it in

conjunction with other indicators can serve as another piece of the technical

analysis puzzle.

Bollinger

Bands

One of the few registered

trademark indicators, Bollinger Bands have been garnering interest recently.

Bollinger Bands, literally bands (as the name indicates) an asset’s 21-day

simple moving average between standard deviations above and below the SMA. It

helps the analysts see volatility more clearly – when volatility is low, the

bands narrow when volatility increases the bands widen.

Another way

Bollinger Bands contextualize trends is as the price moves towards the upper

band it is considered in the overbought region, as the price approaches the

lower band the opposite is true, i.e. the asset is undersold. Unlike other

indicators but similar to RSI, Bollinger Bands do not give specific signals,

but instead an overall look of the markets and volatility.

Also, like RSI,

Bollinger Bands are not design or conceptualized to used alone. According to

the person that created them John, Bollinger, they should be used with other

non-related indicators.

If you have been

trading for long enough then you are well aware that multiple variables

contribute to a successful trading strategy.

Not only should

you use a combination of technical and fundamental analysis but also partner

with a broker that offers the best trading conditions and protections,

for your style of trading.

This

article was submitted by easyMarkets