Products You May Like

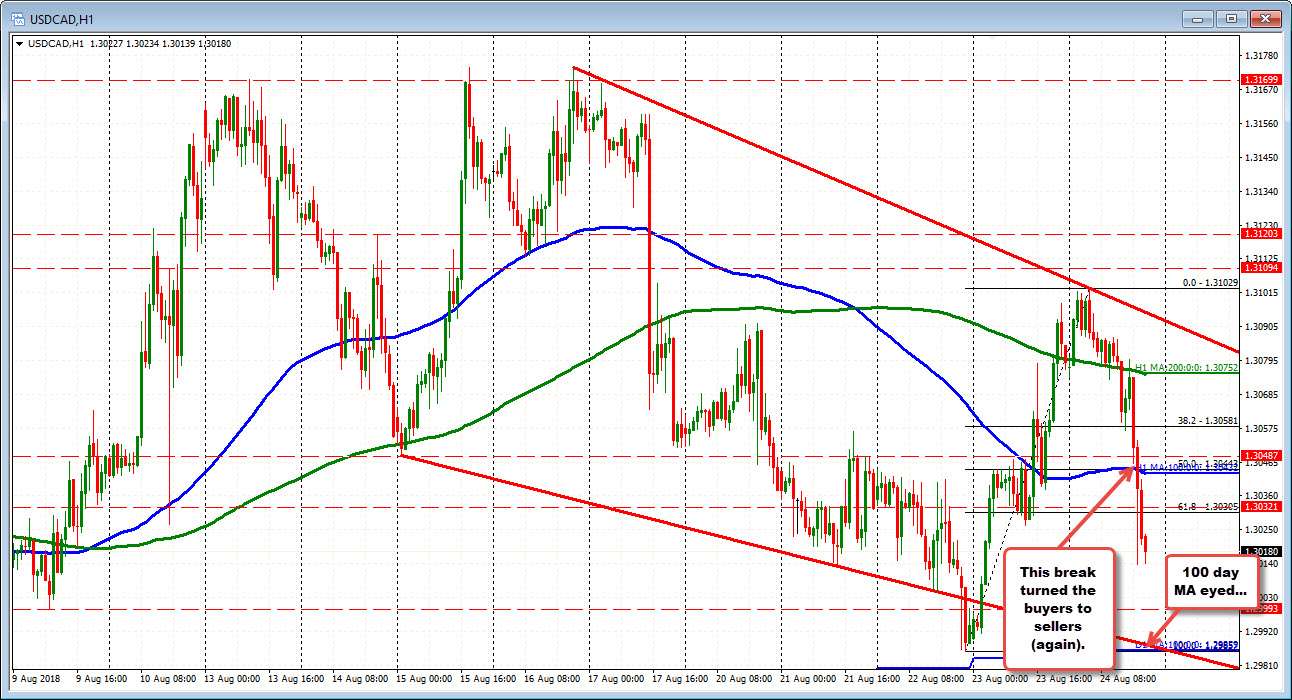

It may be a stretch but the 100 day MA is eyed

The USDCAD is pushing lower. Helping the fall is a run higher in oil and commodities. That tends to help the risk/commodity currencies like the AUD and CAD and indeed they are the strongest currencies today. A weaker USD is also helping of course.

Technically, I posted earlier that the pair was moving toward a key level defined by the 100 hour MA and the 50% retracement at 1.3043 (see post here). The price initially paused ahead of that level, had a modest correction, but then broke below the levels. The price has stayed below. The low reached 1.30138.

It’s Friday afternoon in the summer, so anything can happen, but if the selling continues, the 1.3000 level (low from August 9th) and the 100 day MA at 1.29859 would be targeted.

The 100 hour MA was a barometer for bulls/bears yesterday and today. That remains a barometer for me.

This article was originally published by Forexlive.com. Read the original article here.