Products You May Like

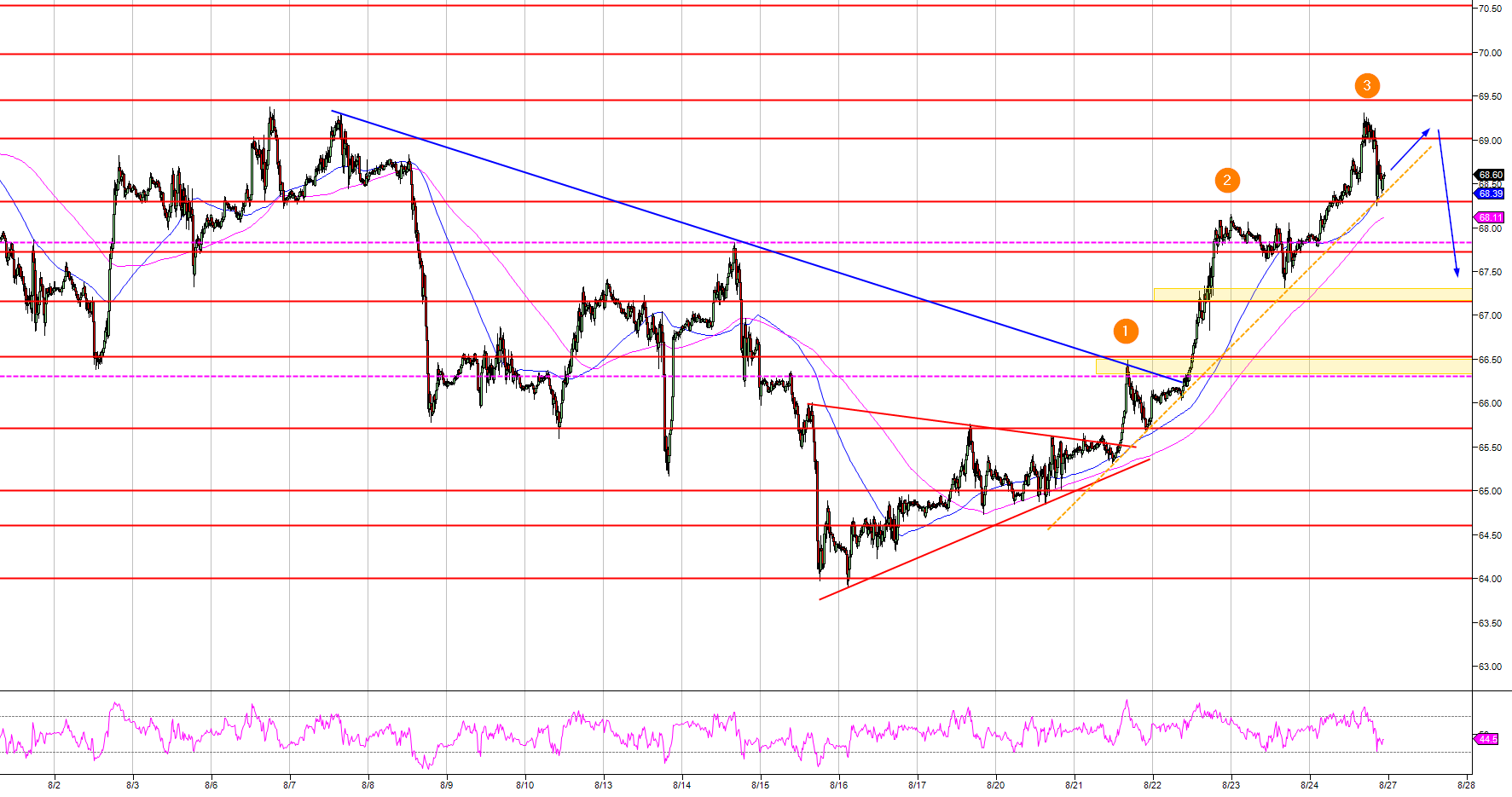

- Crude oil bulls showed on Friday that the main bull trend is still alive despite the deep pullback since early July.

- Oil has made three pushes up (after the red triangle) and the market might be ripe for a pullback down as WTI is finding some resistance at the 69.00 figure and the 50 and 100-period simple moving averages on the daily chart.

- If oil breaks below 68.30, targets to the downside are located at 67.16 and 66.53 swing points. A bull failure on a retest of 69.00 figure can be a short opportunity as well for a near-term revesral down.

Spot rate: 69.60

Relative change: 1.12%

High: 69.28

Low: 67.76

Main Trend: Bullish

Short-term trend: Bearish below 68.30 or a failure above 69.00

Resistance 1: 69.00 figure

Resistance 2: 69.44 June 25 high

Resistance 3: 70.00 figure

Support 1: 68.30 supply/demand level

Support 2: 67.84 August 14 swing high

Support 3: 67.16-67.72 June 14 high-June 26 low

Support 4: 66.30-66.53 area, July 18 swing low and June 20 high

Support 5: 65.71, June 22 low

Support 6: 64.60 May 28 low

Support 7: 64.00 figure

Support 8: 63.63 June 11 low

Support 9: 62.40 June 18 low