Products You May Like

University of Michigan consumer sentiment

-

Lowest since last September

-

Prior was 97.9

-

Current conditions 107.8 vs 114.4 prior

-

Expectations 87.3 vs 87.3 prior

-

1-year inflation expectations 2.9% vs 2.9% prior

-

5-10 year inflation expectations 2.5% vs 2.4% prior

Current conditions at the lowest since late 2016. Here’s the sub-index:

That’s an odds drop given the strength in the stock market but it shows that perhaps the trade battle has consumers worried. The worries about durables are probably due to higher prices of

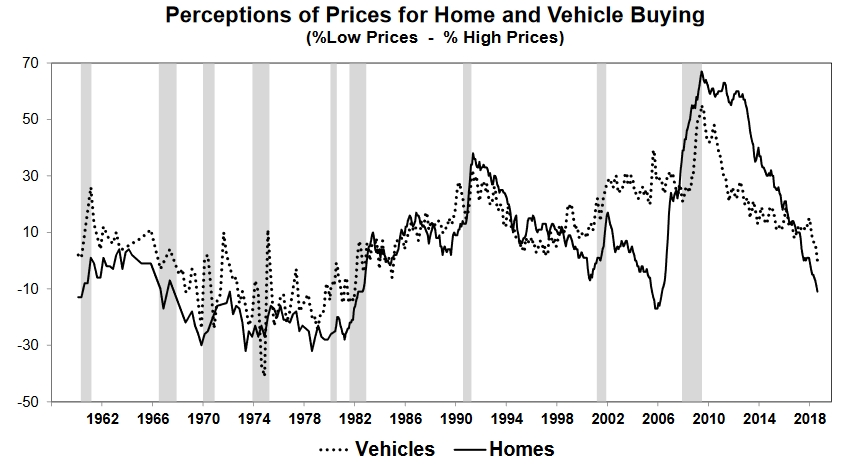

Comments from chief economists Richard Curtin:

“Consumer sentiment slipped to its lowest level since last September,

with the decline concentrated among households in the bottom third of

the income distribution. The dominating weakness reflected much less

favorable assessments of buying conditions, mainly due to less favorable

perceptions of market prices. Buying conditions for large household

durables sank to the lowest level in nearly four years. When asked to

explain their views, consumers voiced the least favorable views on

pricing for household durables in nearly ten years, since October 2008.

Vehicle buying conditions were viewed less favorably in August than

anytime in the last four years, with vehicle prices being judged less

favorably than anytime since the close of 1984. Home buying conditions

were viewed less favorably in early August than anytime in the past ten

years, with home prices judged less favorably than anytime since 2006. These are extraordinary shifts in price perceptions

given that consumers anticipate an inflation rate in the year ahead of

2.9% in early August, unchanged from last month. The data suggest that

consumers have become much more sensitive to even relatively low

inflation rates than in past decades. As is usual at this stage in the

business cycle, some price resistance has been neutralized by rising

wages, although the falloff in favorable price perceptions has been much

larger than ever before recorded. Overall, the data indicate that

consumers have little tolerance for overshooting inflation targets, and

to the benefit of the Fed, interest rates now play a more decisive role

in purchase decisions.”

.