Products You May Like

- Ripple’s XRP has risen nearly 20% following a 75% growth in its futures open interest.

- Options traders could defend the $0.72 level as a large pool of call options is concentrated on that price.

- XRP could rally nearly 50% if it breaks above the neckline resistance of an inverted head and shoulders pattern.

Ripple’s XRP rallied nearly 20% on Tuesday, defying the correction seen in Bitcoin and Ethereum as investors seem to be flocking toward the remittance-based token. On the technical side, XRP could rally nearly 50% if it sustains a firm close above the neckline resistance of an inverted head and shoulders pattern.

XRP open interest spikes amid 20% rise

XRP has seen the highest gains in the top ten cryptocurrencies by market capitalization after Dogecoin in the past 24 hours. While Bitcoin, Ethereum, and Solana struggled to post gains on Tuesday, XRP rose by nearly 20%, suggesting renewed investor interest.

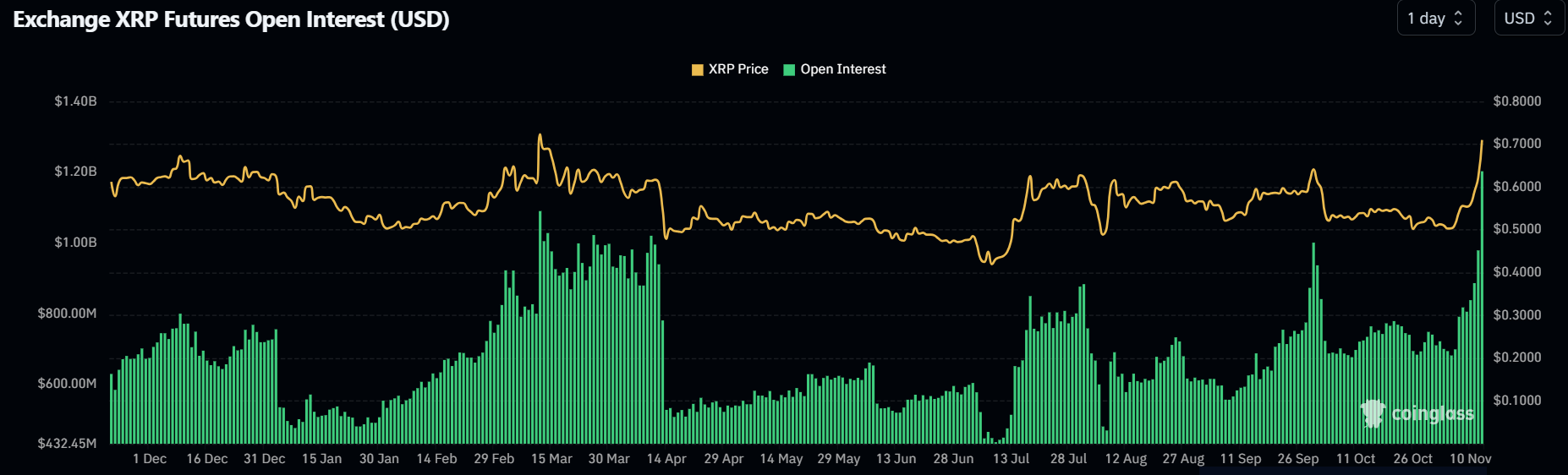

The optimism among investors is visible in XRP’s futures open interest, which has surged by over 75% from $681 million on November 5 to over $1.2 billion on November 12.

XRP Open Interest | Coinglass

Open interest (OI) is the total number of outstanding contracts in a derivatives market. When OI grows alongside prices, it indicates an influx of new capital from investors to support the price uptrend.

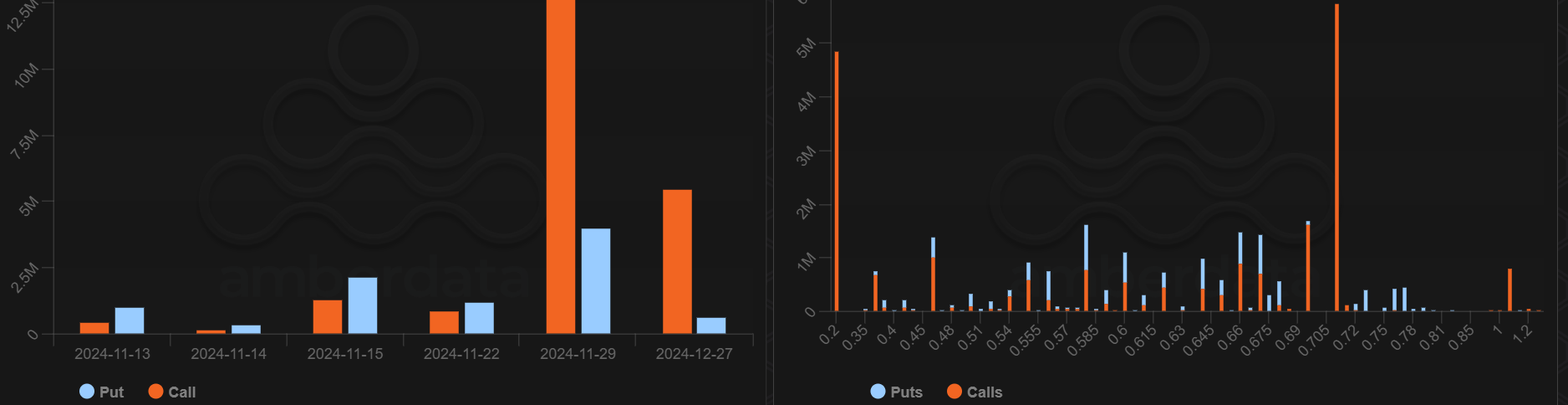

A similar bullish trend is visible in XRP’s options market on the Deribit exchange. According to Amberdata, 5.6 million call contracts are concentrated on the $0.72 strike price at the November 29 expiry.

XRP Options data | Amberdata

Call options are contracts that give an investor the right to buy an asset at a predetermined price within a specific timeframe. Traders buying call options at the $0.72 strike price indicate expectations that prices will rise beyond this level on or before the November 29 expiration. Hence, the huge pool of call traders is incentivized to defend this price level.

Ripple Price Forecast: XRP could rally 50% if it overcomes key resistance

Ripple’s XRP is trading near $0.7300 after recording $21.38 million in liquidations in the past 24 hours. Liquidated long and short positions accounted for $14.37 million and $7.01 million, according to Coinglass data.

On the weekly chart, XRP is showing signs of a massive breakout after breaking above the 100-day Simple Moving Average (SMA) and testing the neckline resistance of an inverted head and shoulders pattern.

XRP/USDT weekly chart

This neckline resistance at $0.7440 is also its yearly high resistance. If XRP sustains an extended breakout above this level, it could rally nearly 50% to a three-year high of $1.100, last seen in November 2021.

On its way up, the remittance-based token must overcome the $0.8547 and $0.9380 key resistance levels to complete the potential 50% rally.

The Relative Strength Index (RSI) and Awesome Oscillator (AO) are above neutral levels, indicating rising bullish momentum.

A daily candlestick close below $0.4893 will invalidate the bullish thesis.