Products You May Like

- DOGE shifts focus toward the SEC as crypto investors expect the examination to reveal abuse in its case against Ripple.

- SEC could pause its appeal against Judge Analisa Torres ruling of XRP retail sales not constituting securities.

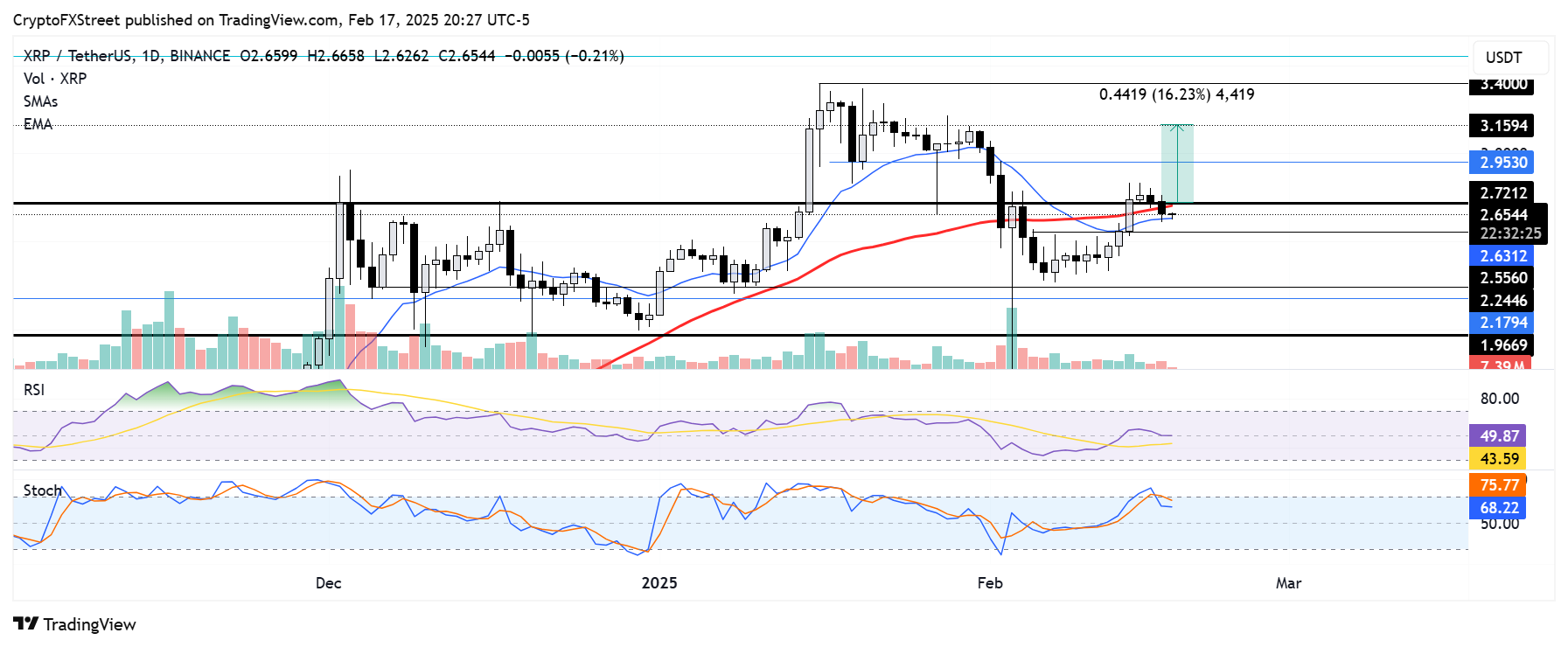

- XRP could decline to $2.24 if it fails to bounce off the $2.55 support and recover $2.72.

Ripple’s XRP saw a 4% decline in the early Asian session on Tuesday following an announcement that the Department of Government Efficiency (DOGE) is targeting the Securities and Exchange Commission (SEC) as the next agency to face its examination process.

DOGE to examine SEC as XRP community members expect a positive outcome

The Department of Government Efficiency (DOGE), spearheaded by Tesla and SpaceX CEO Elon Musk, is shifting its focus to the SEC to examine them for waste, fraud and abuse.

The DOGE’s foray into examining the SEC has increased volatility in the past 24 hours. Most crypto community members anticipate the Ripple vs. SEC case will come under the spotlight during the DOGE’s examination.

If the DOGE finds much waste or abuse related to crypto cases like that of Ripple vs. SEC, it could reinforce opinions that the agency illegally persecuted crypto-related companies under former Chair Gary Gensler.

DOGE has allegedly discovered waste and abuse of goverment funds across several agencies in the US.

Meanwhile, the new SEC administration is set to hold a closed-door meeting concerning the case on February 20. The agency may decide to pause its appeal against Judge Analisa Torres’ ruling — filed by the previous administration — similar to the recent pause it implemented on cases against Binance and Coinbase. Such an outcome could signal the end of its legal battle against Ripple.

This could prompt the approval of XRP ETF applications, which the SEC acknowledged on Friday.

XRP could find support near $2.24 if it fails to recover $2.72

XRP failed to maintain a move above the $2.72 level after experiencing a 3% decline in the past 24 hours. This marks a pullback following its 10% recovery last week.

The 14-day Exponential Moving Average (EMA) near the $2.55 level could provide support for XRP to bounce back above $2.72. However, if the $2.55 support fails, the remittance-based token could decline to the $2.24 support level.

XRP/USDT daily chart

The Relative Strength Index RSI and Stochastic Oscillator are above their neutral levels but trending downwards, indicating weakening bullish momentum.

A daily candlestick close below $1.96 will invalidate the thesis and send XRP toward the $1.35 level.

SEC vs Ripple lawsuit FAQs

It depends on the transaction, according to a court ruling released on July 14, 2023: For institutional investors or over-the-counter sales, XRP is a security. For retail investors who bought the token via programmatic sales on exchanges, on-demand liquidity services and other platforms, XRP is not a security.

The United States Securities & Exchange Commission (SEC) accused Ripple and its executives of raising more than $1.3 billion through an unregistered asset offering of the XRP token. While the judge ruled that programmatic sales aren’t considered securities, sales of XRP tokens to institutional investors are indeed investment contracts. In this last case, Ripple did breach the US securities law and had to pay a $125 million civil fine.

The ruling offers a partial win for both Ripple and the SEC, depending on what one looks at. Ripple gets a big win over the fact that programmatic sales aren’t considered securities, and this could bode well for the broader crypto sector as most of the assets eyed by the SEC’s crackdown are handled by decentralized entities that sold their tokens mostly to retail investors via exchange platforms, experts say. Still, the ruling doesn’t help much to answer the key question of what makes a digital asset a security, so it isn’t clear yet if this lawsuit will set precedent for other open cases that affect dozens of digital assets. Topics such as which is the right degree of decentralization to avoid the “security” label or where to draw the line between institutional and programmatic sales persist.

The SEC has stepped up its enforcement actions toward the blockchain and digital assets industry, filing charges against platforms such as Coinbase or Binance for allegedly violating the US Securities law. The SEC claims that the majority of crypto assets are securities and thus subject to strict regulation. While defendants can use parts of Ripple’s ruling in their favor, the SEC can also find reasons in it to keep its current strategy of regulation by enforcement.