Products You May Like

- Ripple gears up for Ethereum-compatible smart contracts on the XRP Ledger, which should boost functionality.

- Ripple plans to use the Axelar network for cross-chain token transfers; wrapped XRP is the primary token on the sidechain.

- XRP crosses $0.57 early on Tuesday, holds steady above $0.56 at the time of writing.

Ripple (XRP), a cross-border payment remittance firm, made several key announcements in Japan and Korea on September 3. One of the key announcements was the plan for an Ethereum-compatible sidechain on the XRP Ledger.

XRP erases 0.75% of value on Tuesday, holding steady above key support at $0.56.

Daily digest market movers: Ripple to welcome Ethereum-compatible smart contracts on its chain

- Ripple shared plans to boost the functionality of the XRP Ledger by integrating Ethereum-compatible smart contracts through a sidechain.

- The addition would help Ripple expand the utility of its chain beyond basic transactions and include complex applications like decentralized exchanges and token issuance.

- Ripple plans to use Axelar network, a decentralized interoperability platform to facilitate cross-chain token transfers with wrapped XRP (eXRP). eXRP would act as the primary token on the sidechain to facilitate interoperability.

- Smart contracts on Ripple will allow developers to issue tokens, process trades and support functionality for decentralized exchanges and financial applications on the Ledger.

2/ Ripple and the broader XRP community are committed to bringing new programmability, including smart contracts, to the XRPL dev ecosystem in 2025 – through the XRPL EVM sidechain (already in the works) as well as exploring native capabilities on XRPL Mainnet.…

— Ripple (@Ripple) September 3, 2024

- The firm made other key announcements, a partnership in the AI and metaverse space, with Futureverse. The project will assume safe custody of metaverse-related assets for Ripple.

- Ripple’s University Blockchain Research Initiative added Korea’s Yonsei University as a new global partner. Ripple’s research program is aimed at supporting technical developments in blockchain technology.

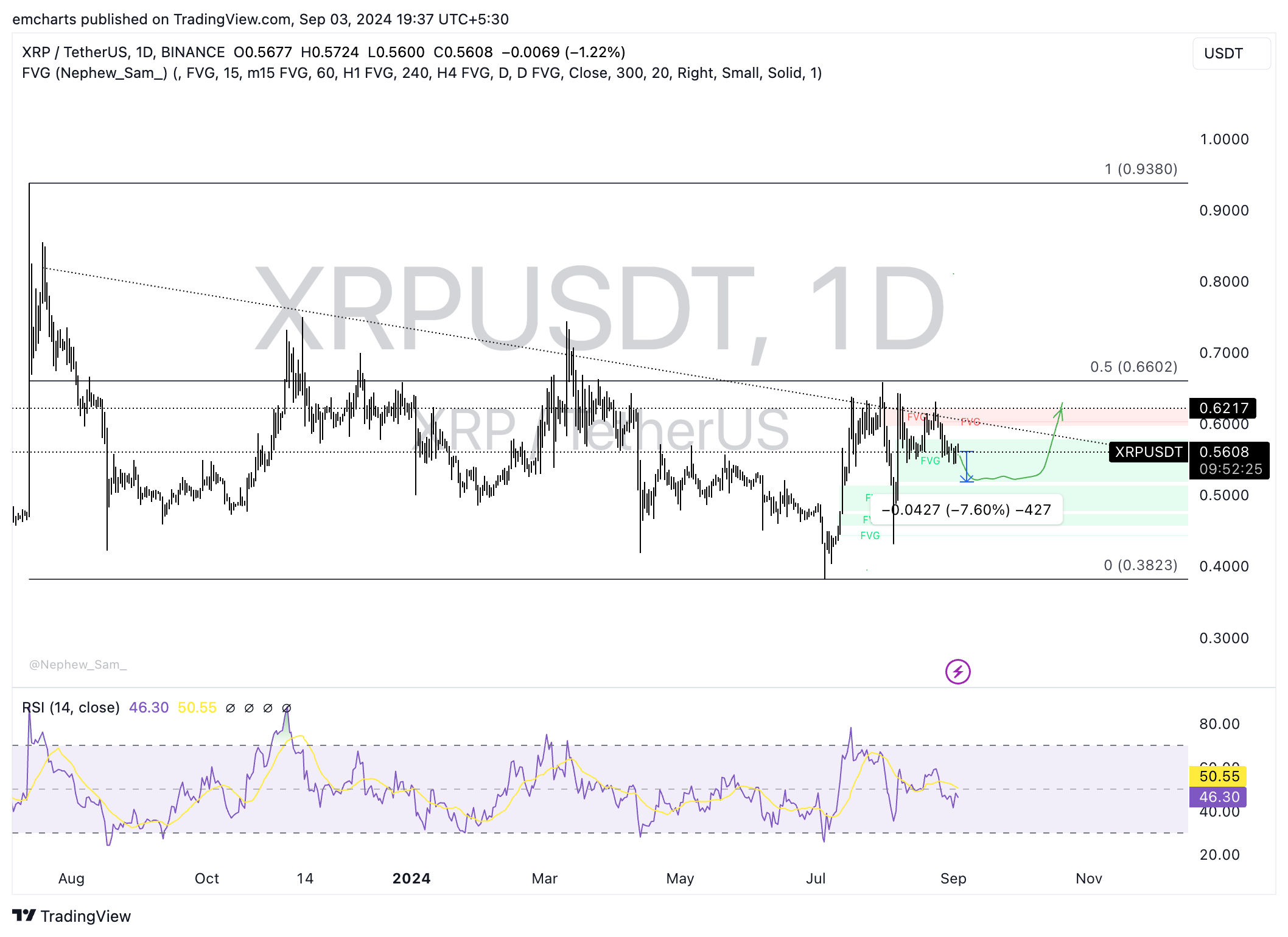

Technical analysis: XRP could extend losses by 7%

XRP trades at $0.5610 at the time of writing. The native token of the XRP Ledger could extend losses further and sweep liquidity at $0.5187. The level marks the lower boundary of the Fair Value Gap (FVG) between $0.5187 and $0.5767.

The Moving Average Convergence Divergence (MACD) indicator flashes red histogram bars under the neutral line. The indicator shows there is underlying negative momentum in XRP price trend.

Relative Strength Index (RSI) reads 46.30 as the indicator climbs toward neutral level at 50.

XRP/USDT daily chart

A daily candlestick close above $0.5767 could invalidate the bearish thesis. Once XRP begins its recovery, the altcoin could attempt to rally to $0.6217, a key resistance level for Ripple.

Cryptocurrency metrics FAQs

The developer or creator of each cryptocurrency decides on the total number of tokens that can be minted or issued. Only a certain number of these assets can be minted by mining, staking or other mechanisms. This is defined by the algorithm of the underlying blockchain technology. Since its inception, a total of 19,445,656 BTCs have been mined, which is the circulating supply of Bitcoin. On the other hand, circulating supply can also be decreased via actions such as burning tokens, or mistakenly sending assets to addresses of other incompatible blockchains.

Market capitalization is the result of multiplying the circulating supply of a certain asset by the asset’s current market value. For Bitcoin, the market capitalization at the beginning of August 2023 is above $570 billion, which is the result of the more than 19 million BTC in circulation multiplied by the Bitcoin price around $29,600.

Trading volume refers to the total number of tokens for a specific asset that has been transacted or exchanged between buyers and sellers within set trading hours, for example, 24 hours. It is used to gauge market sentiment, this metric combines all volumes on centralized exchanges and decentralized exchanges. Increasing trading volume often denotes the demand for a certain asset as more people are buying and selling the cryptocurrency.

Funding rates are a concept designed to encourage traders to take positions and ensure perpetual contract prices match spot markets. It defines a mechanism by exchanges to ensure that future prices and index prices periodic payments regularly converge. When the funding rate is positive, the price of the perpetual contract is higher than the mark price. This means traders who are bullish and have opened long positions pay traders who are in short positions. On the other hand, a negative funding rate means perpetual prices are below the mark price, and hence traders with short positions pay traders who have opened long positions.