Products You May Like

- US spot Bitcoin ETFs recorded outflows of $105.3 million on Wednesday, posting a second consecutive day of outflows.

- On-chain data picture a bearish outlook for Bitcoin as its exchange funding rates are negative.

- French authorities grant bail to Telegram founder Pavel Durov at $5.5 million, supporting crypto market sentiment.

Bitcoin’s (BTC) price recovers from Wednesday’s losses and trades higher by 2.3% at $60,320 at the time of writing on Thursday. However, the recovery could be short-lived as on-chain metrics project a negative outlook, as shown by negative exchange funding rates. At the same time, US spot Bitcoin ETFs posted their second consecutive day of outflows on Wednesday.

Daily digest market movers: Bitcoin ETFs post second consecutive day of outflow

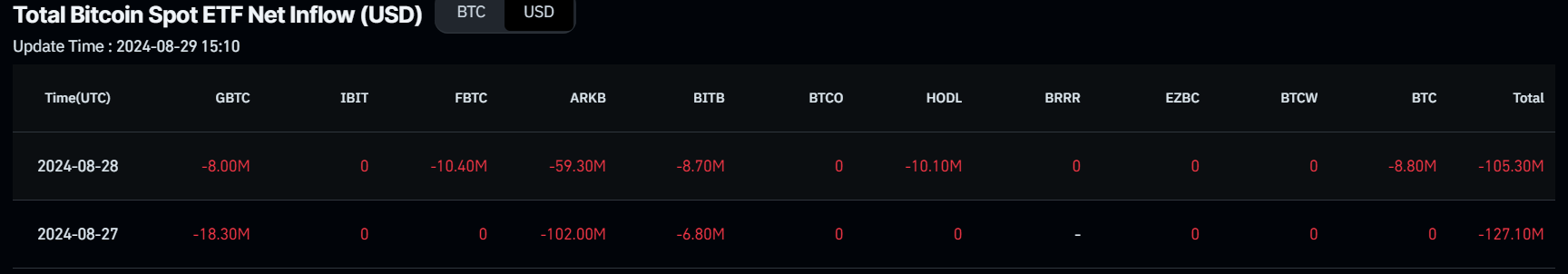

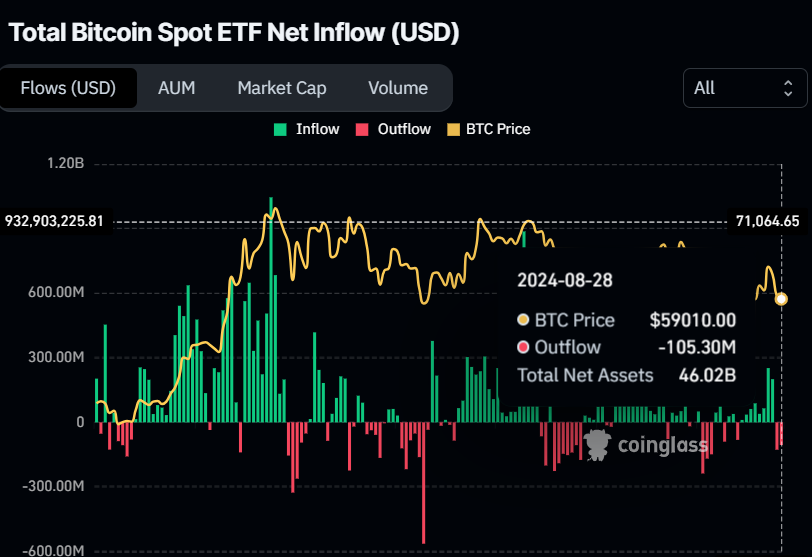

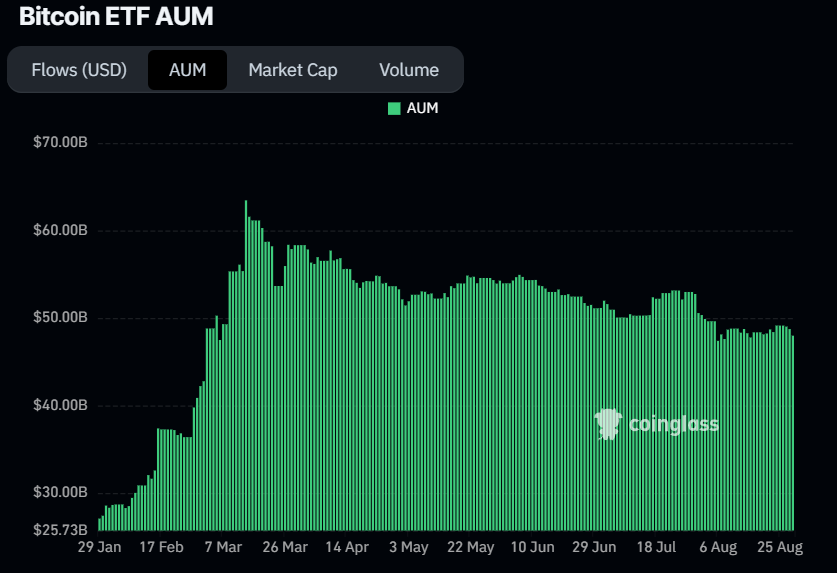

- US spot Bitcoin ETFs registered a second consecutive day of outflow this week, of $105.3 million on Wednesday, according to Coinglass data. As a result, BTC declined by 0.64% on Wednesday and also made a low below $58,000. If this trend continues, Bitcoin’s price could decline further, as ETFs’ net flow data is crucial for understanding market dynamics and investor sentiment. The combined Bitcoin reserves held by the 11 US spot Bitcoin ETFs stand at $46.02 billion, a figure that has been declining since late July.

Bitcoin Spot ETF Net Inflow chart

Bitcoin ETF AUM chart

- According to NBC News, reports surfaced that Paris prosecutors have officially charged Telegram founder Pavel Durov. On Wednesday, French judges set his bail at €5 million ($5.5 million). Under the bail conditions, Durov must remain in France, although prosecutors claim he has “nothing to hide.”

Pavel Durov, the CEO and co-founder of Telegram’s news and messaging app, was taken into custody last weekend at Le Bourget airport and appeared before a judge on Wednesday. French authorities accuse him of enabling criminal gangs to traffic drugs, commit fraud, distribute child pornography, and engage in money laundering, all through Telegram. The bail event has caused some relief in the crypto community as Durov is an influential figure in the crypto space.

- CryptoQuant’s funding rates chart is a crucial indicator for gauging futures market sentiment. Bitcoin’s one currently stands at -0.002, indicating aggressive short selling and the liquidation of long positions. With funding rates now negative, reflecting bearish sentiment and short seller dominance, it shows that short traders are willing to pay long traders, suggesting a bearish sentiment for Bitcoin in the market.

-638605354884750924.png)

Bitcoin Funding Rates chart

- According to Lookonchain data, a whale bought 1,000 BTC worth $59.65 million from the Binance exchange on Thursday. This whale wallet currently holds 7,559 BTC worth $450 million.

A whale bought 1,000 $BTC($59.65M) from the bottom 55 minutes ago and currently holds 7,559 $BTC($450M)!

This whale sold 7,790 $BTC($468.3M) between Jun 27 and Jul 8 before.

Address:

3G98jSULfhrES1J9HKfZdDjXx1sTNvHkhN pic.twitter.com/JPjSOHUm83— Lookonchain (@lookonchain) August 29, 2024

Technical analysis: BTC is poised for down leg

Bitcoin price was rejected around the daily resistance level at $65,379 on Sunday, declining by 8% in the next three days. On Thursday, it recovers slightly by 2.3% at $60,320 at the time of writing.

If BTC continues to decline and closes below the $58,783 level, it could fall further by 4.5% to retest its daily support at $56,002.

The Relative Strength Index (RSI) on the daily chart has slipped below its neutral level of 50, and the Awesome Oscillator (AO) is on its way to close below its neutral level of zero. When both indicators trade below their neutral levels, it suggests a weak momentum and an impending bearish trend.

BTC/USDT daily chart

However, suppose Bitcoin’s price finds support at around $58,783 and closes above $62,042, its 61.8% Fibonacci retracement level (drawn from a high in late July to a low in early August). In that case, the bearish thesis will be invalidated. BTC could rise by 5.5% to revisit its daily resistance level at $65,379.