Products You May Like

- Ethereum sees over $108 million in liquidations as Mt. Gox begins repayment to creditors.

- Grayscale Ethereum Trust switched to trading at a premium to net asset value as spot ETH ETF launch draws closer.

- Ethereum may begin consolidation as key support may prove crucial in coming days.

Ethereum (ETH) is down nearly 5% on Friday following the Mt. Gox BTC repayment, sparking more than $108 million in ETH liquidations. The repayment’s supply strengthened the bearish momentum on Bitcoin, which spiraled into altcoins like ETH.

Daily digest market movers: Mt. Gox headwind, ETHE discount

The defunct exchange Mt. Gox began the repayment of creditors today after transferring about $84.87 million worth of BTC to Japanese exchange Bitbank’s hot wallets. The move increased the prevailing bearish sentiment in the crypto market as altcoins, led by Ethereum, suffered significant declines.

While many expected ETH to be less affected by the wider market sentiment due to the upcoming spot ETH ETF launch, the Securities & Exchange Commission’s (SEC) slow move to greenlight issuers’ S-1 drafts likely gave bears the momentum.

The SEC approved the 19b-4 forms of spot ETH ETF issuers on May 23 but needs to greenlight their S-1s before the products can begin trading. The prospective issuers include VanEck, BlackRock, Bitwise, Grayscale, 21Shares, Fidelity, Franklin Templeton and Invesco.

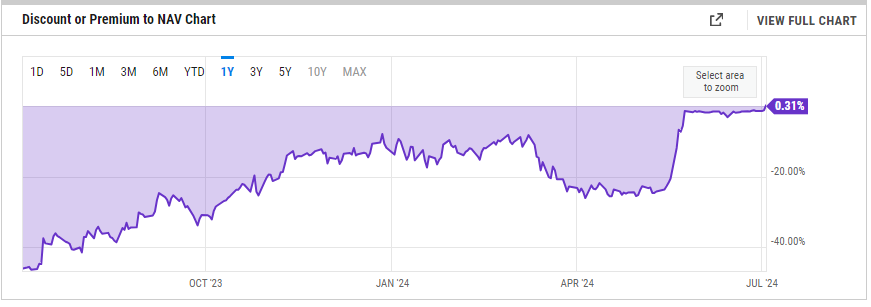

Meanwhile, the Grayscale Ethereum Trust (ETHE) switched from trading at a discount to net asset value (NAV) to a premium of about 0.31% on July 3, according to data from YCharts.

A trust trading at a discount or premium to net asset value means one share of the trust trades below or above the market price of the underlying asset it tracks.

ETHE Discount or Premium to NAV

ETHE has been trading at a discount because investors must sell their shares to exit their positions, as the trust doesn’t allow them to redeem it for cash. The discount particularly increased between March and May after rumors of the SEC’s Ethereum 2.0 investigation.

However, the gap has closed and is now at a premium as investors bought the discounted shares heavily following the SEC’s approval of prospective issuers’ 19b-4 filings. The $9.5 billion ETHE trust will convert to an ETF when spot ETH ETFs go live.

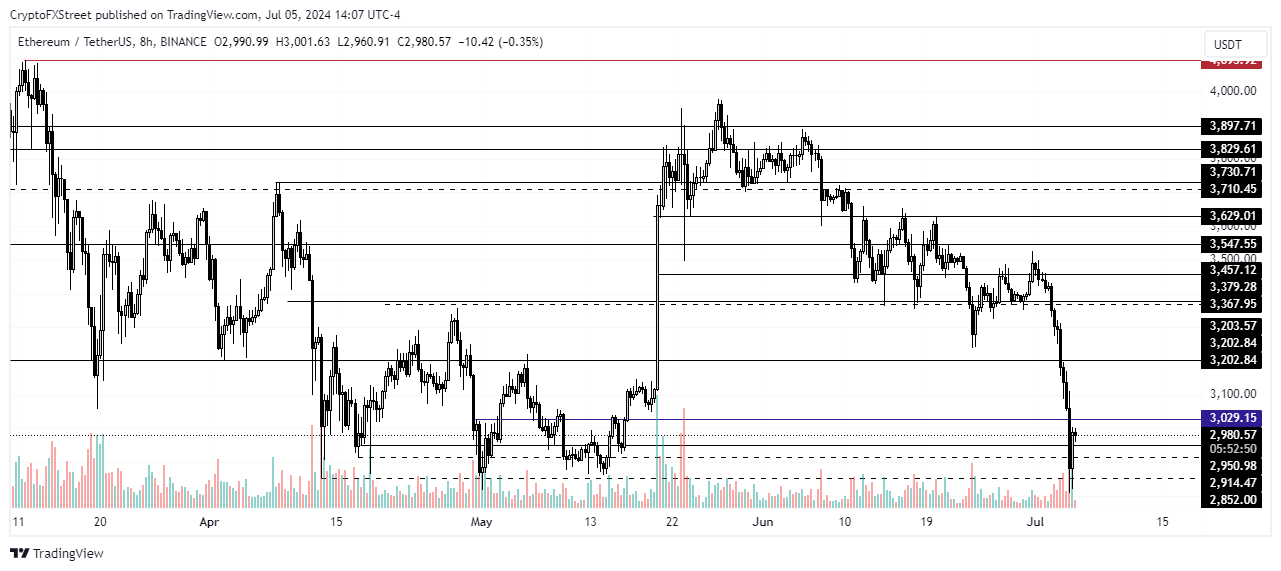

ETH technical analysis: Ethereum may begin consolidation

Ethereum is trading around $2,984 on Friday, down nearly 5% in the past 24 hours. The further decline from Thursday’s lows sparked historic liquidations for ETH, wiping off $134 million of open positions from the market. Long liquidations climbed to $108.4 million, while shorts were shy of $26 million.

ETH’s price has reached the lows of May, when most investors expected a spot ETH ETF denial following reports that the SEC was investigating Ethereum 2.0. ETH broke below the $2,852 key support level but quickly posted a weak exhaustion liquidity void, considering this represents a key demand zone for the top altcoin.

ETH/USDT 8-hour chart

ETH has failed to sustain an extended move below this support level since mid-February. Additionally, IntoTheBlock’s data reveals investors purchased about 57.02 million ETH around the $2,268 to $2,909 price range.

Considering these factors, ETH may not sustain an extended decline below the $2,852 support as the weekend approaches. ETH will likely begin a horizontal trend around the $2,852 to $3,367 price range, where it traded for nearly five weeks (April 12 – May 19).

Cryptocurrency metrics FAQs

The developer or creator of each cryptocurrency decides on the total number of tokens that can be minted or issued. Only a certain number of these assets can be minted by mining, staking or other mechanisms. This is defined by the algorithm of the underlying blockchain technology. Since its inception, a total of 19,445,656 BTCs have been mined, which is the circulating supply of Bitcoin. On the other hand, circulating supply can also be decreased via actions such as burning tokens, or mistakenly sending assets to addresses of other incompatible blockchains.

Market capitalization is the result of multiplying the circulating supply of a certain asset by the asset’s current market value. For Bitcoin, the market capitalization at the beginning of August 2023 is above $570 billion, which is the result of the more than 19 million BTC in circulation multiplied by the Bitcoin price around $29,600.

Trading volume refers to the total number of tokens for a specific asset that has been transacted or exchanged between buyers and sellers within set trading hours, for example, 24 hours. It is used to gauge market sentiment, this metric combines all volumes on centralized exchanges and decentralized exchanges. Increasing trading volume often denotes the demand for a certain asset as more people are buying and selling the cryptocurrency.

Funding rates are a concept designed to encourage traders to take positions and ensure perpetual contract prices match spot markets. It defines a mechanism by exchanges to ensure that future prices and index prices periodic payments regularly converge. When the funding rate is positive, the price of the perpetual contract is higher than the mark price. This means traders who are bullish and have opened long positions pay traders who are in short positions. On the other hand, a negative funding rate means perpetual prices are below the mark price, and hence traders with short positions pay traders who have opened long positions.