Products You May Like

Following the conclusion of its two-day monetary policy review meeting on Friday, the Bank of Japan (BoJ) board members decided to maintain the key interest rate at 0%.

The decision matched the market expectations.

The BoJ held rates for the second straight meeting in June after hiking for the first time since 2007 in the March meeting.

However, the BoJ did not make any changes to its massive JPY6 trillion ($38.14 billion) monthly Japanese government bonds (JGB) buying programme.

Summary of the BoJ policy statement

Will conduct JGB purchases in accordance with decision made at March policy meeting.

BoJ makes decision on JGB purchases by 8-1 vote.

Decided to trim bond buying to allow long-term interest rates to move more freely.

Will decide on specific bond buying reduction plan for the next 1-2 years at next policy meeting.

Will hold meeting with bond market participants on today’s policy decision.

BoJ board member nakamura dissented to decision on JGB purchases.

BoJ’s nakamura dissented to decision on JGB purchases, saying bank should decide to reduce it after reassessing developments in economic activity and prices in July 2024 outlook report.

BoJ’s nakamura was though in favor of idea of reducing BoJ’s purchase amount of JGBs.

Uncertainties surrounding economic, financial developments at home remain high.

Japan’s economy has recovered moderately, although some weakness has been seen.

Inflation expectations have risen moderately.

Financial conditions have been accommodative.

Private consumption has been resilient.

Private consumption has been resilient although impact of price rises has remained and auto sales have continued to be pushed down.

Necessary to pay due attention to developments in financial and forex markets.

Underlying CPI inflation expected to rise gradually.

Industrial output has been more or less flat as a trend.

Industrial output continues to be pushed down recently by suspension of production and shipment at some automakers.

Market reaction to the BoJ policy announcements

USD/JPY jumped sharply in a knee-jerk reaction to the BoJ’s policy announcements. The pair is currently trading at 157.75, up 0.45% on the day.

USD/JPY: 15-minutes chart

Japanese Yen PRICE Today

The table below shows the percentage change of Japanese Yen (JPY) against listed major currencies today. Japanese Yen was the weakest against the Euro.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.03% | 0.07% | 0.46% | -0.02% | 0.08% | 0.26% | -0.00% | |

| EUR | 0.03% | 0.10% | 0.53% | -0.00% | 0.11% | 0.27% | 0.03% | |

| GBP | -0.07% | -0.10% | 0.42% | -0.09% | 0.02% | 0.17% | -0.06% | |

| JPY | -0.46% | -0.53% | -0.42% | -0.48% | -0.38% | -0.23% | -0.45% | |

| CAD | 0.02% | 0.00% | 0.09% | 0.48% | 0.11% | 0.26% | 0.01% | |

| AUD | -0.08% | -0.11% | -0.02% | 0.38% | -0.11% | 0.16% | -0.09% | |

| NZD | -0.26% | -0.27% | -0.17% | 0.23% | -0.26% | -0.16% | -0.23% | |

| CHF | 0.00% | -0.03% | 0.06% | 0.45% | -0.01% | 0.09% | 0.23% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Japanese Yen from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent JPY (base)/USD (quote).

This section below was published on June 13 at 23:00 GMT as a preview of the Bank of Japan Interest Rate Decision.

- The Bank of Japan is largely expected to keep its policy rate unchanged.

- Markets’ attention will be on a potential hawkish message by Governor Kazuo Ueda.

- Further announcements could be around JGB purchases.

The Bank of Japan (BoJ) is expected to maintain its short-term rate target between 0% and 0.1% on Friday, June 14, after concluding its two-day monetary policy review meeting for June.

The decision will be announced at 3:00 GMT on Friday. It is worth recalling that, in March, the BoJ raised the interest rate for the first time in 17 years, ending the negative interest rate policy that had been in place since 2016.

What can we expect from the BoJ interest rate decision?

With a steady policy widely expected at this gathering, market participants will keep their attention on the probable changes in the policy statement for fresh hints on the timing of the bank’s next rate increase.

So far, money markets see around 16 bps of hiking in October and nearly 22 bps at the December 19 meeting, according to Reuters.

Data released on Wednesday revealed that Japan’s wholesale inflation surged in May at the fastest annual rate in nine months. This indicates that the weak Yen is driving up the cost of raw material imports, thereby exerting upward pressure on prices.

This development complicates the central bank’s decision on the timing of raising interest rates, as price increases driven by cost pressures might reduce consumption, undermining the possibility of achieving the demand-driven inflation the BoJ aims for before further scaling back its stimulus measures.

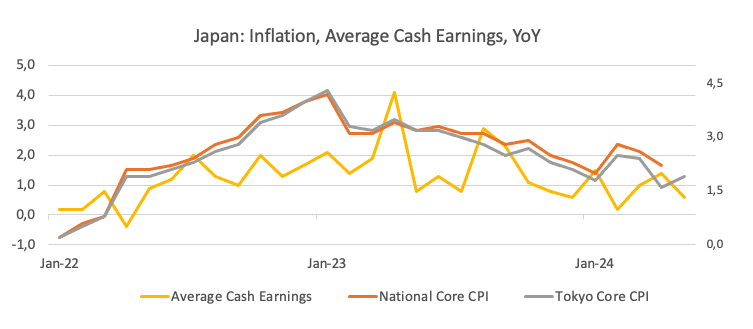

Also pouring cold water over expectations of extra rate hikes, the National Core CPI approached the bank’s target in April (2.2% YoY), while the Tokyo Core CPI navigated below the inflation goal for the second month in a row in May (1.9% YoY).

Last week, Governor Ueda stated that it would be appropriate to scale back the central bank’s bond-buying as it progresses towards ending its extensive monetary stimulus. Ueda also emphasized that the BoJ will proceed “cautiously” in deciding the timing and extent of short-term interest rate increases “to avoid making any significant errors.”

In addition, board member Toyoaki Nakamura also argued last week that the central bank should not raise interest rates solely to slow the Yen’s decline. He explained that attempting to address the weak Yen through interest rate adjustments would negatively impact the economy, as higher borrowing costs would dampen demand.

Analysts at TD Securities comment: “We expect the BoJ to keep the policy balance rate unchanged at 0% and announce a reduction of their JGB monthly purchases to likely around JPY5tn/mth”

How could the Bank of Japan interest rate decision affect USD/JPY?

A hawkish surprise by the BoJ could certainly give the Japanese Yen fresh legs and, therefore, sponsor a knee-jerk drop in USD/JPY. The opposite is likely to happen if the central bank disappoints expectations and signals that the next rate hike is still some time away or that the focus remains on achieving the bank’s inflation target before a move higher on rates.

A glimpse at the broader picture shows Fed-BoJ policy divergence remains at center stage. Following the cautious hold by the Federal Reserve (Fed) at its June 12 event and prospects of just one interest rate cut this year (most likely in December), a sustainable move lower in spot does not appear as the most favourable scenario for the time being.

Looking at the techs surrounding USD/JPY, Senior Analyst at FXStreet.com Pablo Piovano suggests that “further advances are expected to target the weekly high of 157.71 recorded on May 29, followed by the 2024 top of 160.20 from April 29.”

On the downside, “the June low of 154.52 (June 4) emerges as the initial target, ahead of the weekly low of 153.60 reached on May 16 and the provisional 100-day SMA at 152.55”, Pablo adds.

Economic Indicator

BoJ Press Conference

The Bank of Japan (BoJ) holds a press conference at the end of each one of its eight scheduled policy meetings. At the press conference the Governor of the BoJ communicates with media representatives and investors regarding monetary policy. The Governor talks about the factors that affect the most recent interest rate decision, the overall economic outlook, inflation, and clues regarding future monetary policy. Hawkish comments tend to boost the Japanese Yen (JPY), while a dovish message tends to weaken it.

Next release: Fri Jun 14, 2024 06:00

Frequency: Irregular

Consensus: –

Previous: –

Source: Bank of Japan

Japanese Yen FAQs

The Japanese Yen (JPY) is one of the world’s most traded currencies. Its value is broadly determined by the performance of the Japanese economy, but more specifically by the Bank of Japan’s policy, the differential between Japanese and US bond yields, or risk sentiment among traders, among other factors.

One of the Bank of Japan’s mandates is currency control, so its moves are key for the Yen. The BoJ has directly intervened in currency markets sometimes, generally to lower the value of the Yen, although it refrains from doing it often due to political concerns of its main trading partners. The current BoJ ultra-loose monetary policy, based on massive stimulus to the economy, has caused the Yen to depreciate against its main currency peers. This process has exacerbated more recently due to an increasing policy divergence between the Bank of Japan and other main central banks, which have opted to increase interest rates sharply to fight decades-high levels of inflation.

The BoJ’s stance of sticking to ultra-loose monetary policy has led to a widening policy divergence with other central banks, particularly with the US Federal Reserve. This supports a widening of the differential between the 10-year US and Japanese bonds, which favors the US Dollar against the Japanese Yen.

The Japanese Yen is often seen as a safe-haven investment. This means that in times of market stress, investors are more likely to put their money in the Japanese currency due to its supposed reliability and stability. Turbulent times are likely to strengthen the Yen’s value against other currencies seen as more risky to invest in.