Products You May Like

- The Federal Reserve is widely anticipated to keep interest rates unchanged.

- Fed Chairman Jerome Powell could shed further details on upcoming rate cuts.

- The US Dollar could find extra legs in case of a hawkish outcome.

The Federal Reserve (Fed) will announce the first monetary policy of 2024 on Wednesday, and market participants largely expect the Committee to leave the Fed Funds Target Range unchanged at 5.25%–5.50%. If consensus materializes, the January 31 meeting will be the fourth consecutive meeting the bank has kept its interest rates at the highest level in over two decades.

At his latest post-FOMC press conference, Federal Reserve Chair Jerome Powell refrained from giving specific guidance on the timing and pace of rate cuts. However, he emphasized that the Fed would need to implement rate cuts well in advance of annual inflation rates reaching their 2% target. Waiting until the target is achieved could have negative consequences for the economy due to the delayed impact of monetary policy. Additionally, Chair Powell expressed concerns about keeping rates too high for an extended period, as this could potentially hinder economic growth.

In light of the upcoming event, Senior Economist Tom Kenny and Economist Arindam Chakraborty at ANZ comment they continue to adhere to their recent advice that they believe a rate cut around the middle of the year would be fitting, but they must also be receptive to the idea of implementing rate reductions earlier. Monetary policy is no longer following a predetermined path, and the Fed must navigate the delicate balance of achieving sustained inflation at the target while avoiding a rapid increase in real interest rates, which could pose a risk of a sharp economic downturn.

Although there is now a debate among market participants regarding a potential interest rate cut in March or May, it appears that the decision to keep rates unchanged at the January 31 meeting appears to be a “done deal”. According to the FedWatch Tool measured by CME Group, the probability of an interest rate reduction in March surpasses 46% vs. nearly 52% of the same outcome at the May 1 gathering.

Anticipating the Federal Reserve’s Outlook: What Lies Ahead?

Having commenced its tightening efforts in the beginning of 2022, the Fed has executed a total of 525 bps of increases to interest rates and diminished its security holdings by more than $1 trillion. Although these measures have had an impact on the economy, according to Powell, their full effects have not yet materialized. Consequently, determining the duration of the required restrictive policy and the timing for initiating cuts is currently challenging.

In the December Summary of Economic Projections (SEP), it has been revealed that the median member of the Federal Open Market Committee (FOMC) now expects a total of 75 basis points of interest rate cuts in 2024. This represents an increase of 25 basis points compared to the projections made during the September meeting. This adjustment in rate expectations may potentially be attributed to a slight downward revision in the Federal Reserve’s inflation forecasts. The “dot plot” reveals a forecast of four additional interest rate cuts in 2025, totaling a decrease of one percentage point. Furthermore, three more reductions are projected for 2026, which would bring the fed funds rate to a range of 2% to 2.25%, aligning it closely with the long-term outlook.

Earlier this month, FOMC Governor Chris Waller stated that the timing of interest rate cuts in the current year would depend on discussions within the Federal Reserve policy-setting panel. He emphasized his preference to delay rate cuts until the Fed is “reasonably convinced” that inflation consistently reaches the target of 2%.

Similarly, Raphael Bostic, the Atlanta Fed’s counterpart, expressed his willingness to consider implementing interest rate reductions before July if there is “compelling” evidence of inflation slowing down more rapidly than initially expected. While reaffirming the plan to begin rate cuts in the third quarter, he stressed the importance of exercising caution to prevent premature reductions that could reignite demand and inflationary pressures.

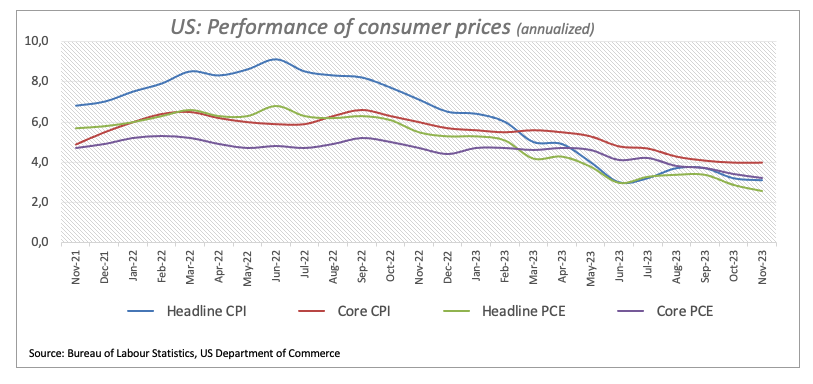

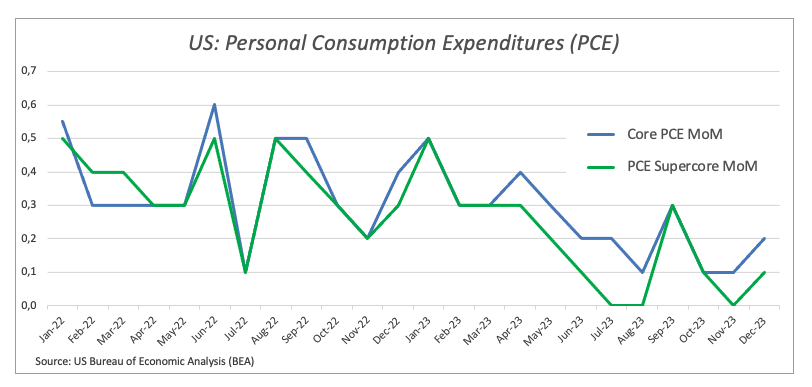

Regarding inflation, Fed officials anticipated a decline in core inflation to reach 3.2% in 2023 (it actually ended the year at 2.9%), dropping to 2.4% in 2024 and then to 2.2% in 2025. Eventually, the expectation is for it to return to the 2% target by the year 2026.

When it comes to inflation tracked by the PCE, the Committee revised its inflation forecast downward at 2.8% for 2023 (the official data eventually came out at 2.6% for December), then 2.4% in 2024, 2.1% in 2025, and 2.0% in 2026.

When will the Fed announce policy decisions and how could they affect EUR/USD?

The Federal Reserve is scheduled to announce its decision and publish the monetary policy statement at 19:00 GMT. This will be followed by Chairman Jerome Powell’s press conference at 19:30 GMT. There won’t be an updated dots plot this time.

While it is widely expected that policymakers will maintain the current interest rates at 5.25%, market participants will closely scrutinize Chair Jerome Powell’s remarks for any hints regarding the timing of potential rate cuts, especially given the recent decrease in expectations for rate cuts in March.

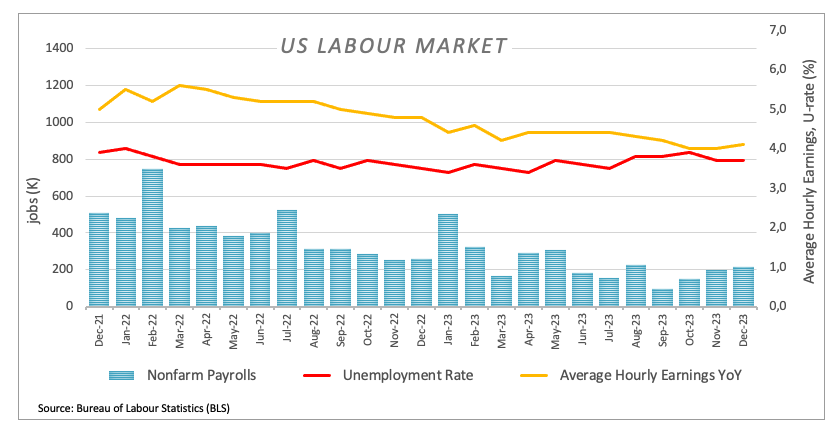

As the Federal Reserve gets ready for its first meeting of a new year, its challenges look different from those from, say, a year ago. By this time, disinflationary pressures appear to be running firm against the backdrop of higher interest rates, diminishing energy costs and a still pretty tight labor market, all amidst a healthy resilience of the US economy.

Recent strong US fundamentals have reinforced the view above, paving the way for an increasingly likely “soft landing”. On this, Chair Powell is expected to keep a cautious tone and emphasize that there is still work to be done regarding inflation, while keeping the Fed’s data-dependent stance intact.

Other than that, investors should be closely monitoring any signs from Powell regarding the timing of the potential start of an easing cycle

Pablo Piovano, Senior Analyst at FXStreet, notes: “The USD Index (DXY) seems to have embarked on a consolidative phase around the 103.50 zone in the last couple of weeks, in quite a vigilant stance ahead of imminent key events. Around this area also coincides with the critical 200-day SMA. The surpassing of this region could open the door to further gains in the short-term, with an interim target at the 100-day SMA around 104.30, where the December 2023 highs also sit. On the downside, a rapid loss of momentum should not see any contention of significance until the December 2023 low in the 100.60 zone.”

Regarding EUR/USD, Piovano adds: “EUR/USD has kicked off the new trading year well on the defensive, uninterruptedly shedding more than three cents since late December peaks near 1.1140 amidst the resurgence of a strong bid bias in the US Dollar. The loss of the so-far 2024 low around 1.0795 could expose extra weakness to the December low at 1.0723. In case of bouts of strength, the pair should need to subsequently clear the 55-day SMA around 1.0910, seconded by the weekly top around the psychological 1.1000 barrier just to refocus on the December high near 1.1140.

Finally, Piovano suggests that a sustained decline below the critical 200-day SMA in the 1.0840 area should shift the pair’s outlook to the downside, which would allow for a deeper decline initially to the December 2023 low at 1.0723 (December 8). Further losses from here should require an important worsening of the EUR’s outlook, which appears to be unlikely for the time being.”

FOMC speech tracker: Lack of dovish remarks in the new year

Federal Reserve officials alternated some cautious vocabulary with several hawkish speeches, before the 10-day blackout period ahead of their first FOMC meeting and interest rate decision of 2024. December and January have been notable for the lack of dovish speeches from FOMC board members, refusing to commit to any specific dates or targets for rate cuts.

That said, the general tone going into the meeting is still notably balanced, as over 70% of the analyzed speeches came out with a neutral tone towards monetary policy, enhancing the data-driven approach the Federal Reserve has enforced over the last months.

*Voting members in 2024.

**0-10 scale where 0 is most dovish and 10 is most hawkish.

FOMC speech counter

| TOTAL | Voting members | Non-voting members | |

|---|---|---|---|

| Hawkish | 5 | 4 | 1 |

| Balanced | 18 | 13 | 5 |

| Dovish | 0 | 0 | 0 |

This content has been partially generated by an AI model trained on a diverse range of data.

Economic Indicator

United States FOMC Press Conference

The press conference is about an hour long and has two parts. First, the Chair of the Federal Reserve (Fed) reads out a prepared statement, then the conference is open to questions from the press. The questions often lead to unscripted answers that create heavy market volatility. The Fed holds a press conference after all its eight yearly policy meetings.

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates.

When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money.

When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions.

The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system.

It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.