Products You May Like

- Litecoin halving event is due on August 4, barely four days out, with investors monitoring the countdown.

- The event will drop mining rewards by 50%, from 12.5 to 6.25 LTC per block.

- The altcoin is up 5% with a 24-hour trading volume increase of 50% to almost $5 million.

- Historically, the BTC fork sees major moves around halving events on the back of the “buy the rumor sell the news” case or a typical post-halving rally.

Litecoin price is trading with a bullish bias, after taking off in style on July 25. The altcoin continues is rising on the back of a major event in the ecosystem that has investors anticipating a major move.

Also Read: Trading bots feted as UniBot on-chain volume nears 10 million in 24 hours

Litecoin price turns bullish ahead of the LTC halving

Litecoin (LTC) price is on course north, moving along an uptrend line with prospects for more gains. This comes ahead of the LTC halving, slated for August 3. The event will see mining rewards reduce from the current 12.5 LTC to 6.25 LTC per block. Notably, there are up to 2,227 blocks left, meaning the halving events are far from over, with a project of the last one happening in the year 2142.

Litecoin Halving Countdown

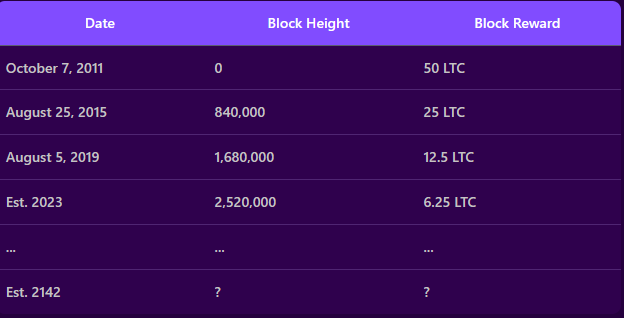

Litecoin halving defines an event where rewards to miners will be cut in half. The process goes back to around eight years ago when the first halving of this crypto happened. It takes place every four years, as indicated in the schedule below.

Litecoin Halving Schedule

Litecoin price forecast

At the time of writing, Litecoin price is $94.66, recording a daily rise of almost 5%. This comes amid surging trading volume, up 50% in the last 24 hours to breach the $5 million mark. These points to increased interest in the altcoin that could bode well for its market value.

Historically, LTC, which is a Bitcoin fork, sees major moves around halving events on the back of the “buy the rumor sell the news” case or a typical post-halving rally. As the price action moves along an uptrend line, Litecoin price could score more gains for investors.

Momentum indicators favor this outlook with the Relative Strength Index (RSI) indicating a bullish divergence against the Litecoin price. This happens when the price edges north against an overall foaling RSI. The result of such a technical formation is often a strong move north.

Similarly, the Awesome Oscillators (AO) histograms are soaked in green, suggesting bulls are leading the market. If buying momentum is sustained, LTC could breach the $100 level to tag the $102.73 resistance level. Such a move would constitute a 10% upswing.

Conversely, early profit takers could break the current uptrend, causing a pullback below the ascending trendline. A decisive break below the $87.02 support could invalidate the bullish thesis.

Like this article? Help us with some feedback by answering this survey: