Products You May Like

The Dollar Index is another tool for your trading toolbox

You don’t have to be reading analysts posts or market wraps for

very long before you come across references to the US Dollar Index. The US

Dollar Index is a very useful tool in your trading as it can confirm a

directional bias for the currency pair you are trading and also warn you of any

headwinds that your trade might face before you pull the trigger. The

Federal Reserve is the most important central bank in the world with the US

dollar being the most traded currency in the world, comprising of around 70% of

all transactions on a given day. So, having a handle on what the Dollar is

doing overall on any given day is going to be a key advantage for any

trader. The Dollar Index will help you do just that.

So, what is the US Dollar Index?

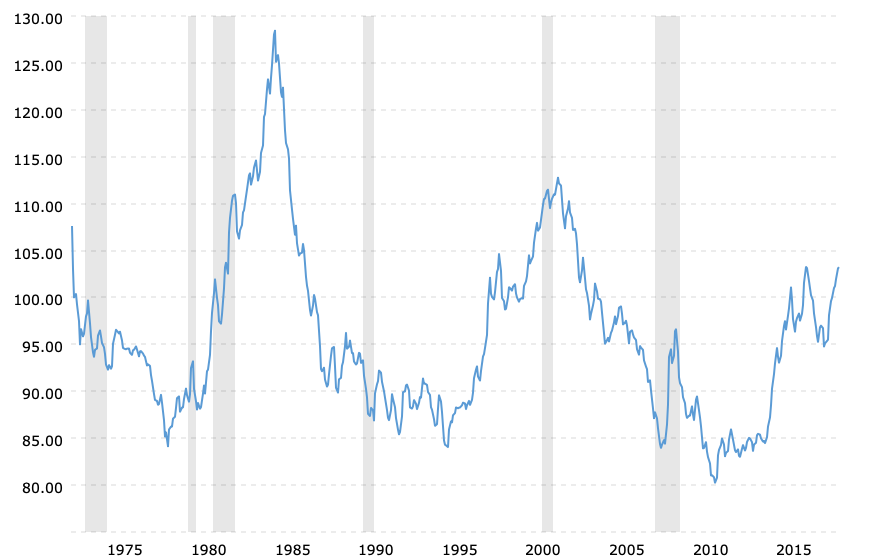

The US Dollar Index (USDX) started in March, 1973 for

a value of 100.000. In February 1985 it traded as high as 164.7200 (depending

on your price feed) and in March 16, 2008 it traded as low as 70.698. At time of writing it sits around 95.32. You

can see the approximate, historical

range of the Index below.

The US dollar Index compares the USD to a basket of currencies

The US Dollar Index is a measure of the value of the US dollar in

relation to the value of a basket comprised of some of the US’s most important

trading partners. The Index is comprised of six foreign currencies. Due to the

fact that all these countries are not the same size ,the Euro for example comprises of 23 countries, the

USD Index gives varying weight to each currency. The biggest proportion of the

Dollar Index (USDX) is made up of the EURO which has a 57.6% weight. The

currencies are weighted in the following ways:

- The

Euro (EUR), 57.6% weight - The

Japanese Yen (JPY), 13.6% weight - The

Great British Pound (GBP), 11.9% weight - The

Canadian Dollar (CAD), 9.1% weight - The

Swedish Krona (SEK), 4.2% weight - The

Swiss Franc (CHF) 3.6% weight

It will become immediately apparent that the Index is heavily

influenced by the Euro. This gives us the first clue as to how the USD Index

can be useful for making trading decisions.

The USDX is the Anti-Euro Index

When the Euro loses values this mean the Dollar Index gains

value. The nearly 60% average weighting means that the EUR/USD pair and the

USDX are inversely correlated.

In the chart below, since May 2018, the EUR/USD has been steadily falling

In contrast below, since May 2018, the US dollar Index has been

rising.

Armed with this knowledge the US dollar Index becomes an

excellent indicator for the EUR/USD. At the time of writing the Index is

testing the daily 200 moving average while the EURUSD is testing the daily 200

moving average. The Dollar Index can be eyed for clues as to the EUR/USD’s next

move

The US Dollar Index is a guide for the direction of the USD in

any pair

Trading any pair with a USD half will be guided by the USD index,

so here are a couple of key facts to keep in your mind:

•If the USD is the base currency (USD/xxx ), then

the US dollar Index and the currency pair will typically move in the same

direction.

•If the USD is the quote currency. (xxx/USD) then

the US dollar index and the currency pair will typically move in opposite

directions.

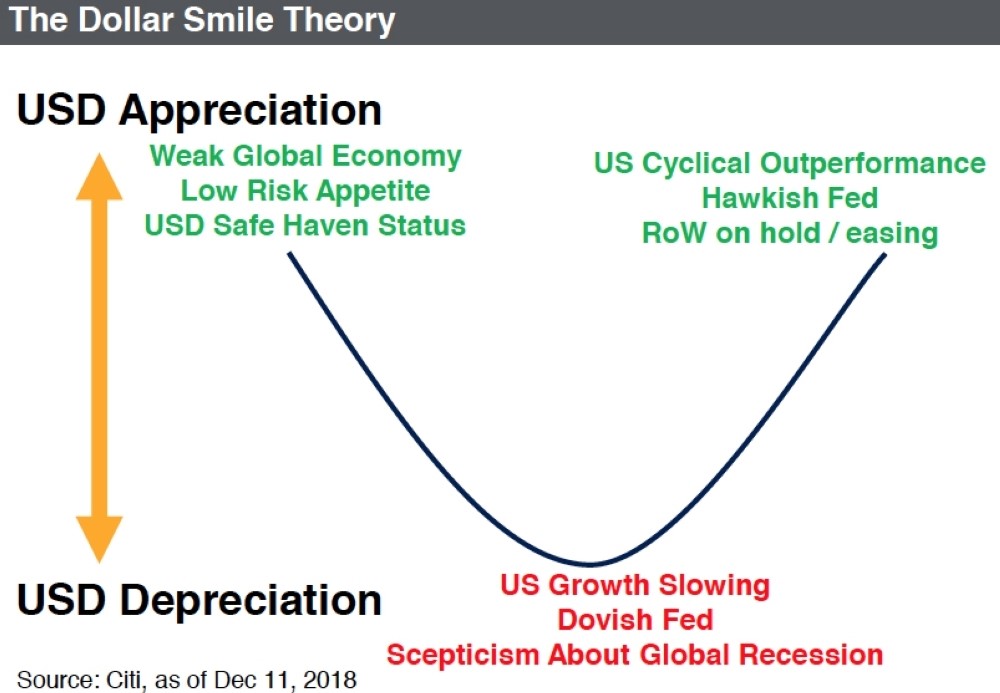

The US dollar index and the smile theory.

The US dollar index can give you a quick broad picture

of the dollar and help you see what is going on with the market. The

smile theory is worth mentioning since it is such a good way of

mentally holding the three varying ways the dollar responds to different

situations. If you look at the picture below you can see a kind of smile.

On

the left hand side of the smile you have USD strength , which is when the

global economy is struggling. This is where you have JPY, CHF strength and USD

gains too as money is put into less risky dollars, The bottom part of the smile

is where the USD depreciates on a dovish Fed. At the time of writing, in

January 2019, the USD is falling with a more reserved Jerome Powell looking to

the data before continuing the pace of hike rates. The right part of the smile

is when the USD gains value on a hawkish fed and risk on environment. This smile theory is useful as a quick rule of thumb

for understanding the dollars present position and what is likely to happen

next. By getting into the habit of noticing the USD index as soon as you start

trading you can speed up your analysis on the dollar and also gain invaluable

insights to inform your next trading decision.