Products You May Like

AUD/USD breaks the September low and falls to its lowest levels in 2.5 years

As Treasury yields continue to soar higher, it has inadvertently also helped yields in Australia (and Japan) rise as well today. Australian 5-year bond yields are up by 4 bps while 10-year bond yields are up by 7 bps on the day.

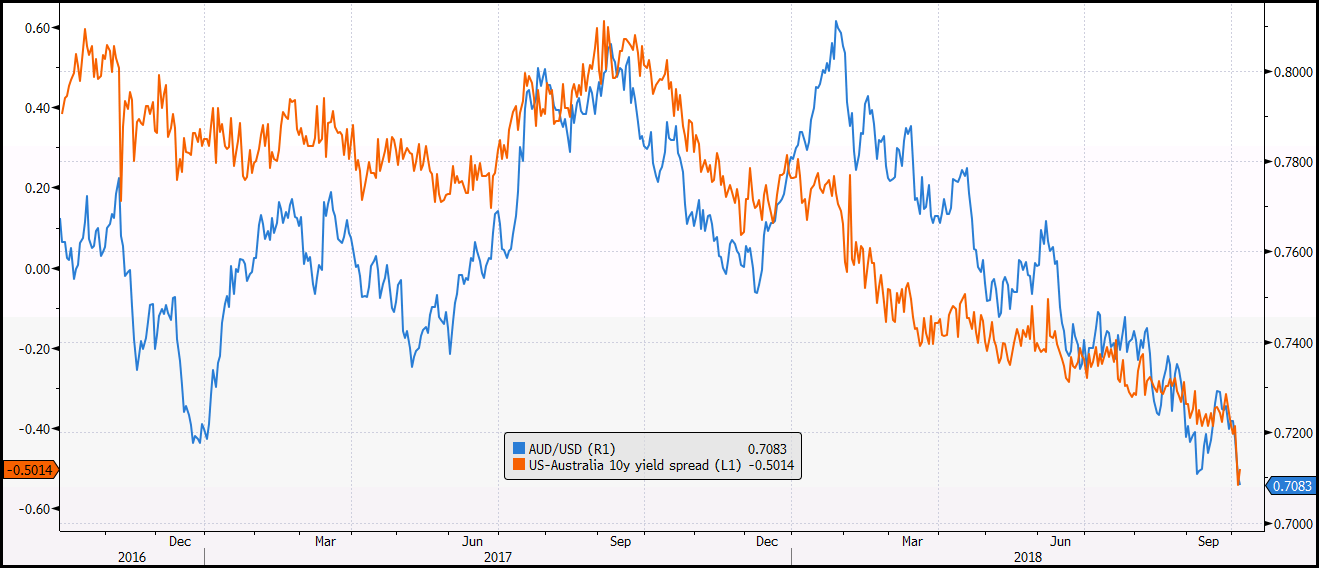

But put into context, when I wrote about the yields spread between Australia and US bonds yesterday it was sitting at 43 bps in favour of Treasuries. Today, it is at 50 bps:

At this juncture, sellers will be eyeing a move towards the 0.7000 handle for AUD/USD. And with Treasury yields looking to rise further, it will help to provide a tailwind for the dollar to advance against the aussie for the time being. Aside from stretched positioning in aussie shorts, I can’t argue for any other reason why AUD/USD should move higher at this point in time.