Products You May Like

TALKING POINTS – US DOLLAR, POWELL, FED, AUSSIE DOLLAR, RBA, CAD, USMCA

A lackluster offering on the European economic calendar is likely to see currency markets looking ahead to a speech from Fed Chair Jerome Powell for direction cues. He is due to opine on the US economic outlook at an event hosted by the National Association for Business Economics (NABE). An upbeat tone echoing last week FOMC policy announcement may boost 2019 rate hike bets and send the US Dollar higher.

See our US Dollar forecast to see what is likely to set the trend in the fourth quarter!

TALKING POINTS – US DOLLAR, POWELL, FED, AUSSIE DOLLAR, RBA, CAD, USMCA

The Australian Dollar was little-changed followinga status-quo monetary policy announcement from theRBA. Governor Philip Lowe and company kept the baseline cash rate at 1.5 percent as widely expected and signaled continued stasis in the near term. Priced-in policy bets implied in bank bill futures envision an increase no sooner than October of next year.

The Canadian Dollar continued to move higher, building on explosive gains scored yesterday after negotiators managed to strike a deal on a revamped NAFTA trade agreement after over a year of haggling. The new framework will be called the “US-Mexico-Canada Agreement”, or USMCA. Hopes for a deal emerged on Friday, starting what would become the largest two-day rise since January 2016.

See our free guide to learn how you can use economic news in your FX trading strategy!

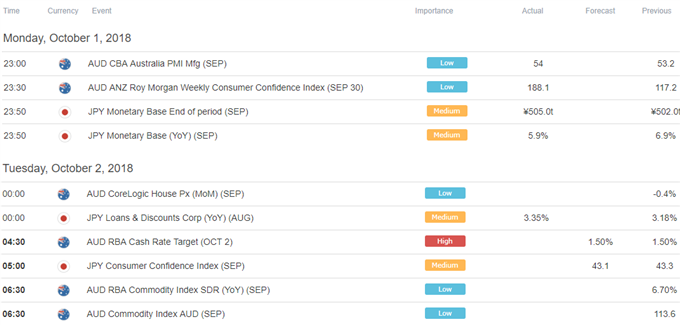

ASIA PACIFIC TRADING SESSION

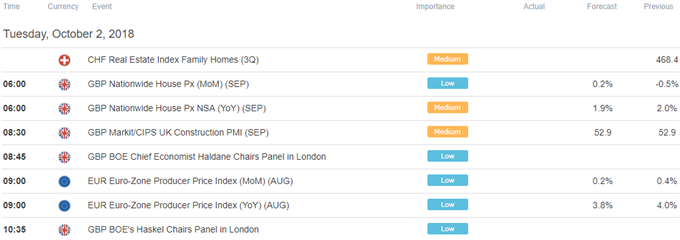

EUROPEAN TRADING SESSION

** All times listed in GMT. See the full economic calendar here.

FX TRADING RESOURCES

— Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter