Products You May Like

Trading the News: Australia Employment Change

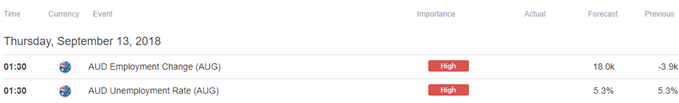

Updates to Australia’s Employment report may fuel a larger recovery in AUD/USD as job growth is expected to rebound 18.0K in August.

A batch of positive developments may trigger a bullish reaction in the Australian dollar as it instills an improved outlook for growth and inflation, and signs of a more robust economy may encourage the Reserve Bank of Australia (RBA) to gradually change its tune ahead of 2019 as ‘members continued to agree that the next move in the cash rate would more likely be an increase than a decrease.’

As a result, a marked rebound in Australia Employment may curtail the recent weakness in AUD/USD, but another below-forecast print may fuel fresh yearly lows in the aussie-dollar exchange rate as market participants push out bets for an RBA rate-hike. Sign up and join DailyFX Junior Currency Analyst Daniel Dubrovsky LIVE to cover the updates to Australia’s employment report.

Impact that the Australia Employment report has had on AUD/USD during the last print

|

Period |

Data Released |

Estimate |

Actual |

Pips Change (1 Hour post event ) |

Pips Change (End of Day post event) |

|

JUL 2018 |

08/16/2018 01:30:00 GMT |

15.0K |

-3.9K |

+28 |

+23 |

July 2018Australia Employment Change

AUD/USD 5-Minute Chart

Australia unexpectedly shed 3.9K jobs in July, with the Unemployment Rate narrowing to 5.3% from 5.4% per annum in June as the Participation Rate slipped to 65.5% from 65.7%. Despite the below-forecast print, a deeper look at the report showed a 19.3K expansion in full-time positions was offset by a 23.2K decline in part-time employment.

The Australian dollar gained ground despite the mixed data prints, with AUD/USD bouncing back from a low of 0.7214 to close the day at 0.7260. Learn more with the DailyFX Advanced Guide for Trading the News.

AUD/USD Daily Chart

- Broader outlook for AUD/USD remains tilted to the downside as both price and the Relative Strength Index (RSI) preserve the bearish trends from earlier this year, but the series of failed attempts to close below the 0.7090 (78.6% retracement) to 0.7110 (78.6% retracement) region raises the risk for a larger recovery as the exchange rate snaps the series of lower-highs carried over from the previous week.

- A closing price above the 0.7170 (23.6% expansion) to 0.7230 (61.8% expansion) region to bring the 0.7230 (61.8% expansion) hurdle on the radar, which largely lines up with the monthly-high (0.7236).

Additional Trading Resources

New to the currency market? Want a better understanding of the different approaches for trading? Start by downloading and reviewing the DailyFX Beginners Guide!

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

— Written by David Song, Currency Analyst

Follow me on Twitter at @DavidJSong.