Products You May Like

Forex news for NY trading on September 7, 2018

In other markets:

- Spot gold is down -$3.39 or -0.29% at $1196.50

- WTI crude oil settled the week at $67.75. CLICK HERE

- Bitcoin had a quieter day today (after a couple days of big declines). The digital currency is trading down -$17.61 at $6425. The price fell back below the 100 day MA this week at $6871.51. That level is now a risk defining level for shorts.

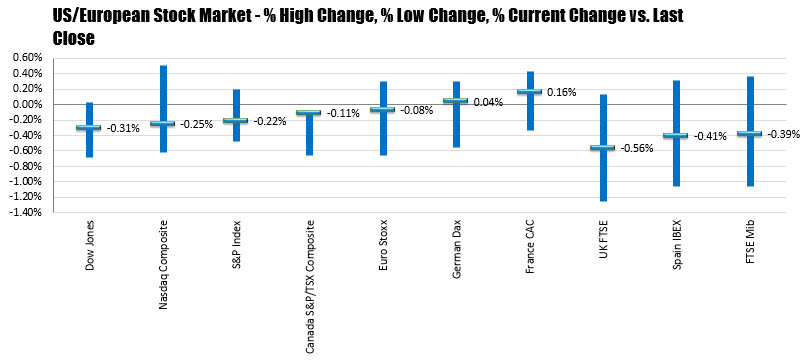

The US stock indices ended the day lower today. European shares were mostly lower although the German Dax and France Cac ended the day with small gains.

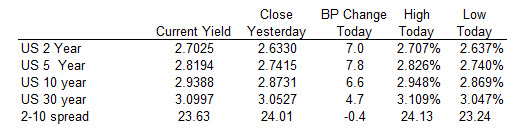

In the European debt market, the benchmark 10 year yields ended the day with mostly higher yields.

In the European debt market, the benchmark 10 year yields ended the day with mostly higher yields.

- Non Farm payroll rose 201K vs 191K expected.

- 2-month payroll revision -50K

- Hourly wages 0.4% vs 0.2% exp..

- Wages YoY 2.9% vs. 2.7% exp. Best YoY vs 2009.

- Private payrolls 204K vs +194K expected

- 3 month average NFP 185K

- Prior private payrolls 170K (revised to 153K)

- Manufacturing -3K vs +23K exp

- Unemployment rate 3.9% vs 3.8% expected

- Prior unemployment rate 3.9%

- participation rate 62.7 versus 62.9 last

- Hours of work. 34.5 vs 34.5 last

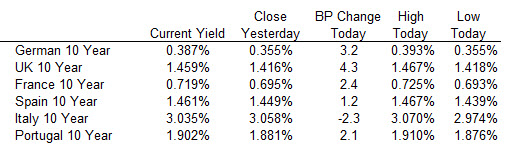

You could nit-pick about the revisions. You can look at the unemployment rate moving to 3.9% vs 3.8% expectations. However wages came in better than expected, and that was the main catalyst for a higher dollar and expectations that 2 more hikes (one later in September and one in December) is likely.

A weaker China economy as a result of the trade war (and potentially weaker global economy), is not good new for Australian and New Zealand who rely on exports to China for some of the GDP growth. As a result, most of the dollar gains has its roots in those two currencies today/this week. The EURUSD was also pressured today (down -0.54%).

….more