Products You May Like

The USD mostly lower

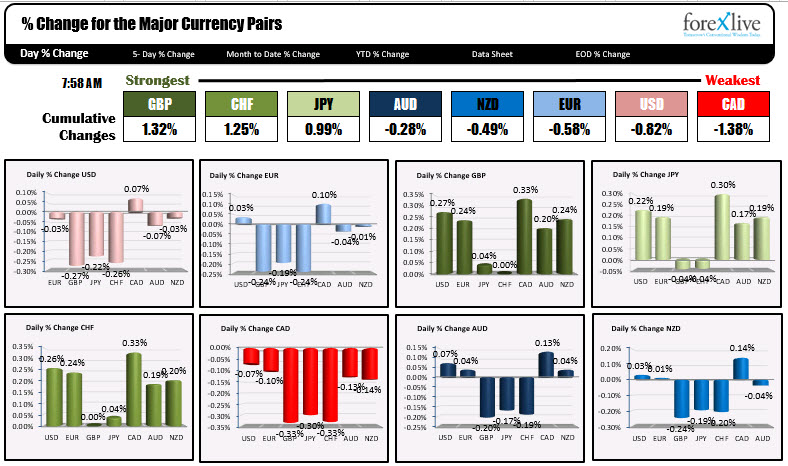

As North American traders enter for the day the GBP is the strongest, while the CAD is the weakest. The USD is lower just ahead of the ADP report and other US data including ISM services data later this morning. China tariffs may also be announced. The ADP is expected to add 190K at 8:15 AM ET/1215 ET. Initial claims will also be announced with the expectations of 213K and NonFarm productivity for 2QF at 3.0% vs 2.9%.

The % changes are relatively modest with the major currencies fairly close together as markets digest the economic and global landscape.

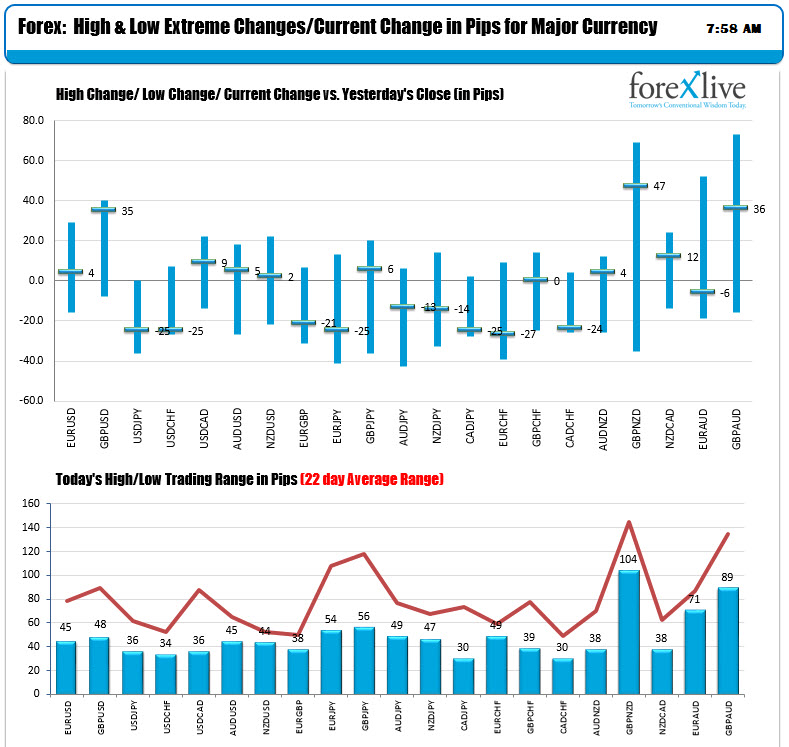

The ranges (lower chart below) is showing the inactivity. The ranges are all well below their 22 day average ranges (about a month of trading). For the USD, the GBPUSD and USDCHF are near extreme levels. The EURUSD, USDCAD, AUDUSD and NZDUSD area all within 9 pips of the close from yesterday.

In other markets:

- spot gold is trading up $7.50 or 0.63% at $1204.35

- WTI crude oil futures are trading up $.08 or 0.12% at $68.80

- Bitcoin continues its weakness seen this week. It is down $-550 at $6397 and has also moved below it’s 100 day moving average at $6880.22. Other crypto currencies are also pressure with litecoin down -9.16%, ethereum down -8.27%, and ripple down -4.21%

US stocks futures are implying a marginally higher opening:

- Dow is up 32 points

- Nasdaq is up 6 points

- S&P is up 2.5 points

In the US debt market, yields are little changed:

- two-year 2.649%, unchanged

- five-year 2.768%, unchanged

- 10 year 2.904%, +0.1 bps

- 30 year 3.085%, +0.9 bps