Products You May Like

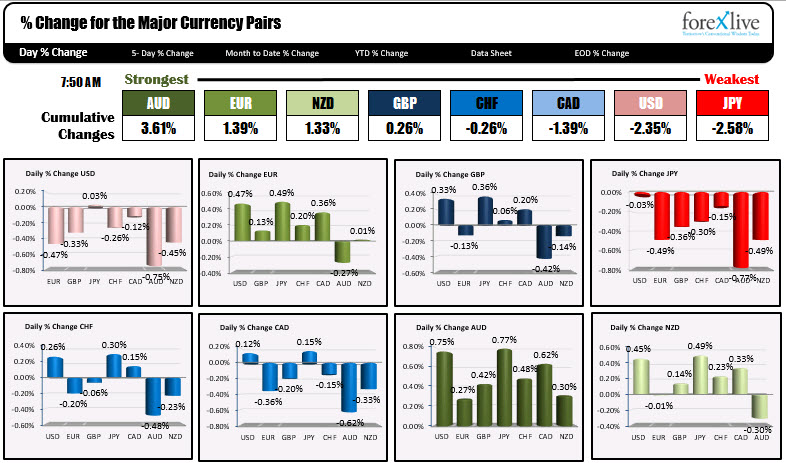

The USD is weaker as the market prepares for Durable Goods and Fed’s Powell

The AUD got creamed yesterday but rebounded today on the ousting of PM Turnbull. Scott Morrison is now Prime Minister after winning the spill against former PM Malcolm Turnbull.

The JPY is the weakest. Fed’s Bullard has helped the dollar weaken over the near term as he said the Fed should not take on the yield curve (amongst other dovish comments).

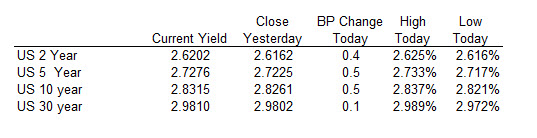

Chairman Powell will speak at 10 AM ET and market will be focused on what he has to say with regard to Fed independence, effects of trade tensions and perhaps even the yield curve. The 2- 10s spread is down to 21.3 bps.

Durable Goods orders will be released at 8:30 AM ET with expectations of -1.0% vs 0.8% last. The Ex transportation is expected at 0.5% vs 0.2%. Cap Good shipments Nondef ex air is expected up 0.3% vs 0.7%.

The USD is weaker with gains only against the JPY ahead of Durables and Powell.

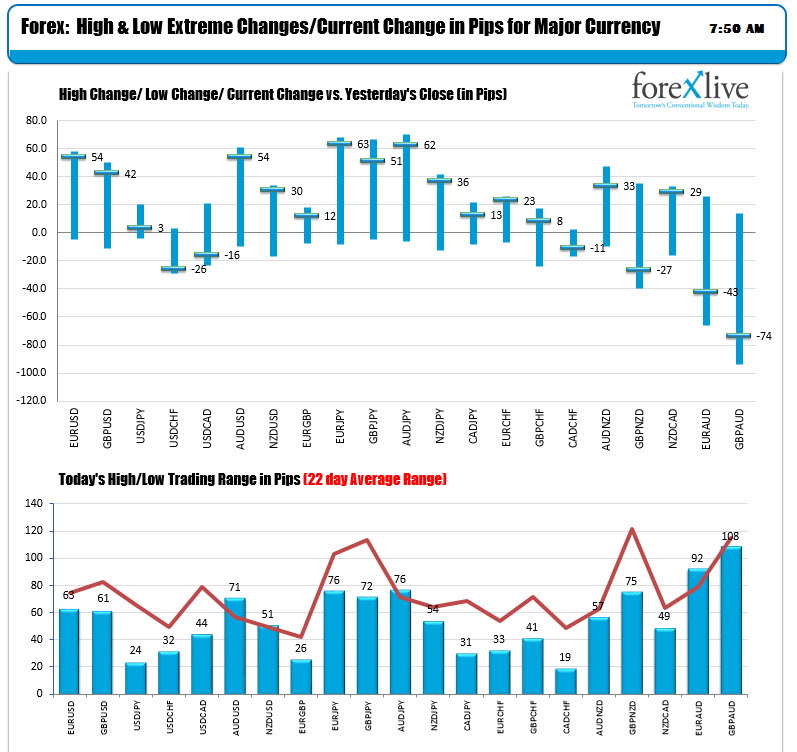

Below is the changes and ranges. The USD is near the highs vs all the major currency pairs. The JPY pairs are higher.

A snapshot of other markets shows:

- spot gold is up $7.15 or 0.6% at $1192.80

- WTI crude oil futures are up $.72 or 1.06% at $68.55

US stock futures imply a higher opening:

- Dow is up 74 points

- NASDAQ is up 20.6 points

- S&P is up 5.5 points

European stocks show:

- German Dax up 0.16%

- France’s Cac up 0.4%

- UK FTSE up 0.2%

- Spain’s Ibex up 0.35%

- Italy’s FTSE MIB up 0.61%

US yields are near unchanged on the day:

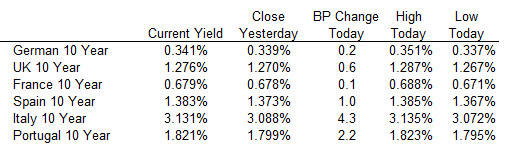

The benchmark 10 year yields in Europe are modestly higher with the Italy 10 year and Portugal yields up the most.

The benchmark 10 year yields in Europe are modestly higher with the Italy 10 year and Portugal yields up the most.