Products You May Like

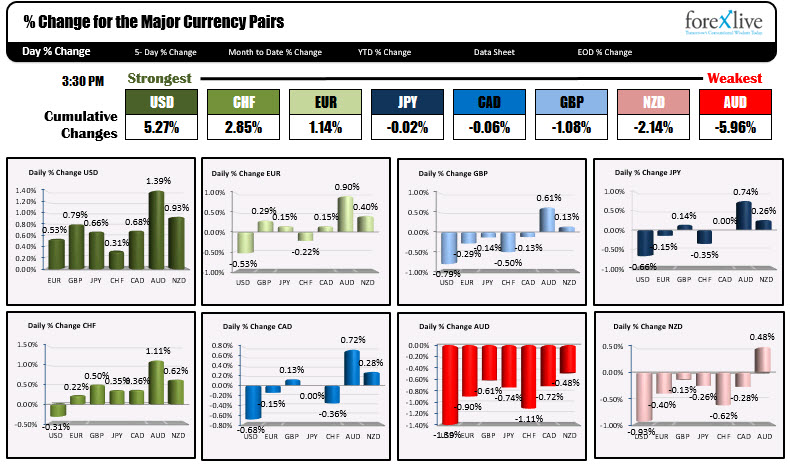

The run away winner today

The USD was higher at the start of the NA session today, but it took off and is ending as the runaway strongest currency of the day. Equally as impressive was the tumble in the AUD as it struggles from political uncertainty and trade issues with China.

Below is a technical look at some of the major pairs into the new day:

EURUSD

The EURUSD fell below the 200 bar MA on the 4-hour chart at 1.15955 and an upward trend line in the Asians session. Support was found on the initial to 1.15409. That was my levels from Tuesday’s trade. Later in the session was broken and the price is looking to test the 100 hour moving average at 1.15226. Below that the 100 bar moving out of 4 hour chart comes in at 1.15054. Those are targets into the new trading day. The bias on the day is more bearish but the 100 hour moving average needs to be broken, and stay broken in the new trading day.

USDJPY

The USDJPY is ending the day at day highs. It is also up testing the 200 hour MA on the 4-hour chart at 111.332. A trend line connecting highs from the last 2 trading weeks also comes in at that level. If the level is broken, the 111.47 (50% of the move down from the July 19 high) and the 111.87 (61.8%) become targets. If the 111.33 level does hold, a rotation back down toward the 100 bar moving average on the 4 hour chart at 110.94 will be a downside target.

GBPUSD

The GBPUSD is ending the day close to its session lows. The pair in the NY session fell below a trend line on the hourly chart and the 100 hour MA /38.2% retracement. If the sellers are to remain in control, risk at the 100 hour MA at 1.2637 will be eyed (currently trading at 1.2804). The 1.2798 is the 50% of the move up from August 15, and below that the 200 hour MA at 1.27814 will be eyed. Look for buyers on the first test of the 200 hour MA.

USDCAD

In the last few hours, the price of the USDCAD has moved above both the 200 hour MA and the 50% retracement at 1.3080 (trade at 1.3085 currently). The high extended to 1.3093. The easy trade for the pair is long above the 1.3080 level. On a break back below, the bias should return to more bearish.

AUDUSD

The AUDUSD took two steps lower today. The first took the price to the 200 hour MA and the 50% at 0.7791. The second took the price below a swing area on the hourly chart between 0.72507 and 0.72544. The price fell below that area in the last few hours of trading and moved to a low of 0.7240. In the new day, close resistance will be at 0.7254. Stay below would be more bearish. A move above would target 0.7270. For traders looking to risk more and stay with the bearish trend, the 200 hour MA and the 50% at 0.7791 has to hold any corrective rallies. Failure to do so, and I would expect sellers to turn to buyers.