Products You May Like

Volatility is slowing as the pair consolidates.

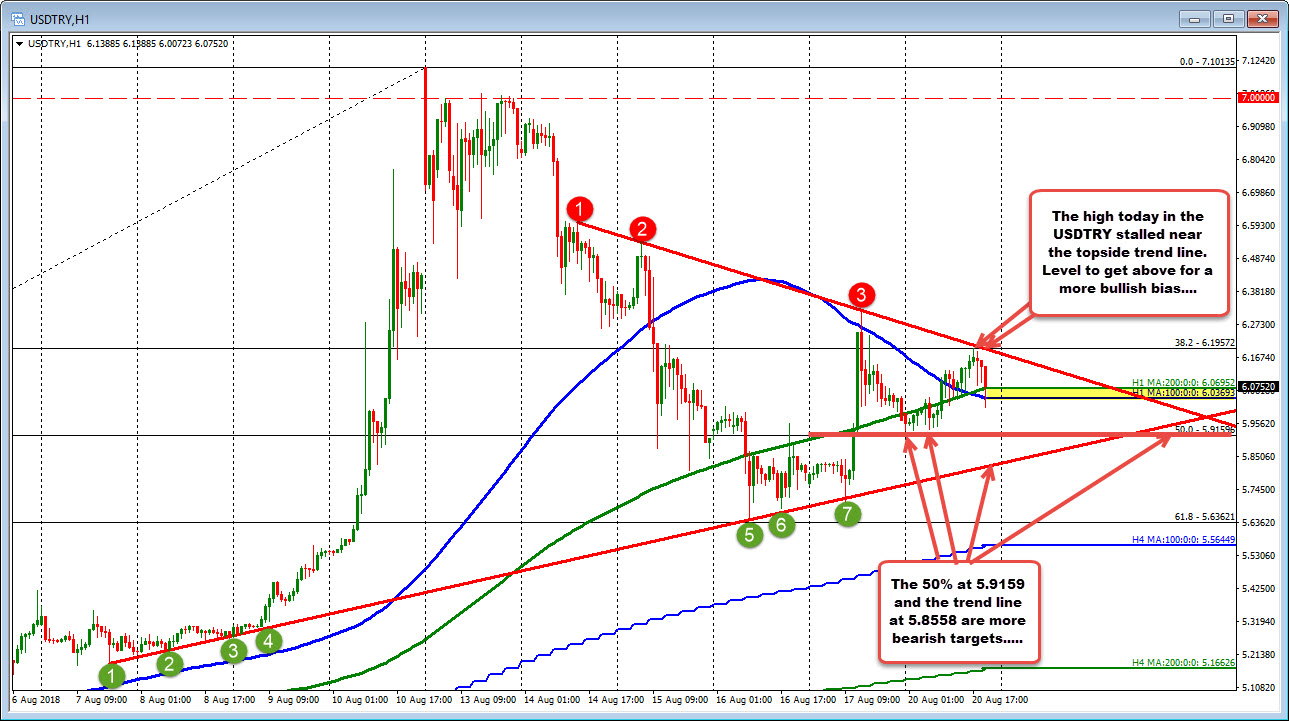

The hoopla from the Turkish lira’s tumble has slowed a bit as the correction off the high last Monday made it to the 61.8% of the move up from the July 23rd lows at 5.6362 (the low reached 5.6504).

The rally off the low last week moved to the 100 hour MA and a topside trend line on Friday after earlier in the day stalled at the lower trend line. Those lines mean something technically going forward – move above the topside trend line is more bullish. Move below the lower trend line is more bearish.

In between is the 100 and 200 hour MAs at 6.0369 and 6.0695. The pair trades around those MAs now.

So, the volatility is down. The price has corrected of the run higher and corrected off the lows from last week. Which way the next shove is will have traders looking at the converging trend lines AND the 100/200 hour MAs.