Products You May Like

- Bitcoin wallet active again after nearly 11 years per on-chain data.

- Bitcoin miner wallet addresses from the Satoshi era recently came back online for profit taking or transferring funds to alternate addresses.

- Bitcoin trades at $65,647, holding steady above key support on Sunday.

Bitcoin (BTC) whale wallets from the time when creator Satoshi was still online have recently noted activity. Miner wallets from this era and whale wallets from nearly 11 years ago either transferred funds or took profits on their holdings in September.

Bitcoin holds steady above support at $65,000.

Bitcoin whale wallet activated after nearly 11 years

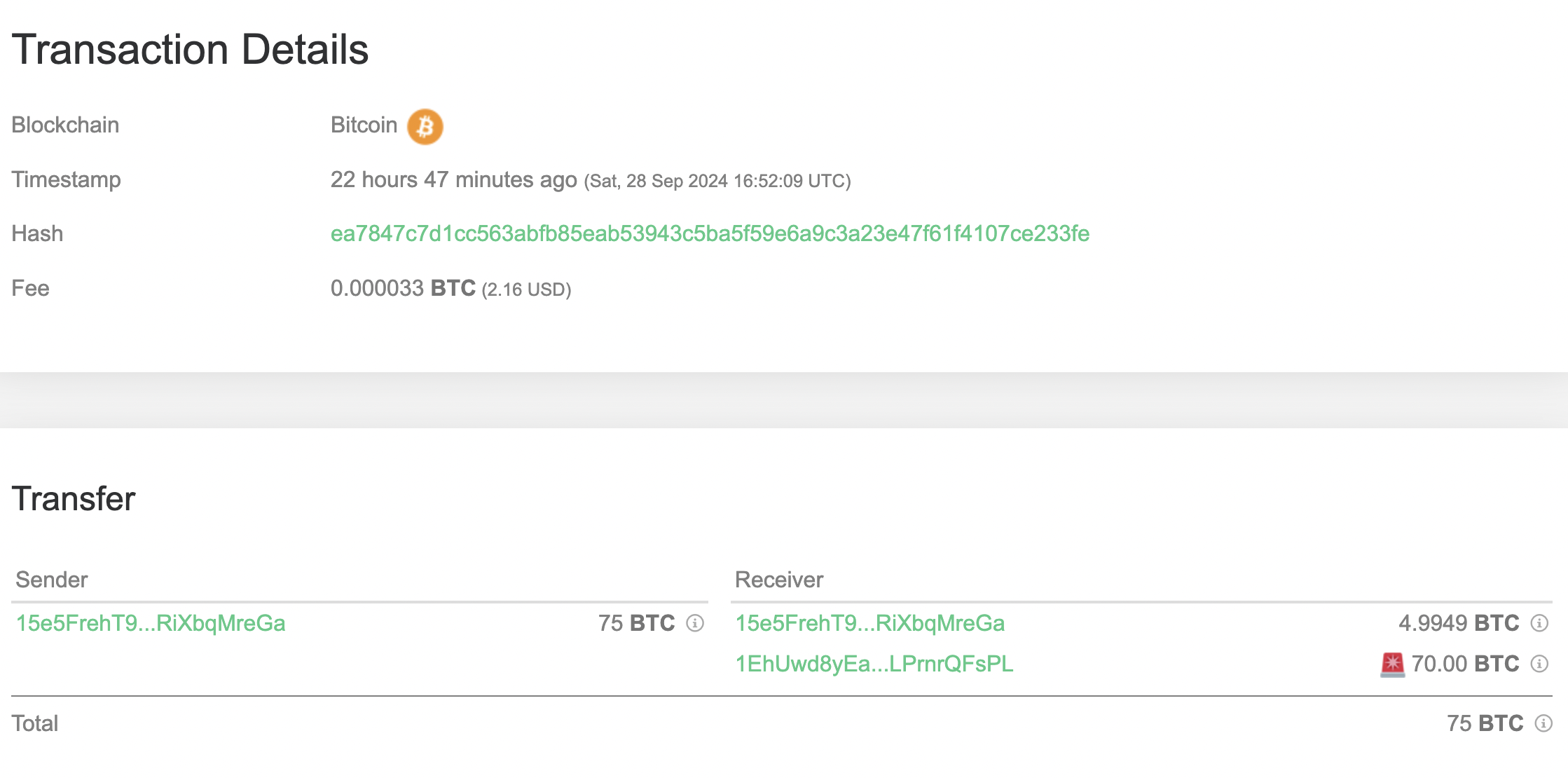

Data from on-chain tracker Whale Alert shows a wallet address that contains 150 Bitcoin worth $9.8 million USD is back online as of Saturday, September 28. The wallet transferred BTC to two different addresses nearly 22 hours ago. Over 75 BTC was transferred by the large wallet investor.

Transaction details of the whale wallet

Over $16 million in Bitcoin was on the move a week ago, as miner wallet addresses from 2011, when Satoshi was last active on the online forum, resumed activity.

Please note that many miner wallets dormant for more than 15.5 years are transferring $BTC!

5 miner wallets have transferred 250 $BTC($15.9M) in the past hour.

These wallets received 50 $BTC($3.18M) as mining rewards per block back in 2009.

Address:… pic.twitter.com/HktJivt7Qy

— Lookonchain (@lookonchain) September 20, 2024

It remains unclear whether wallet addresses from the past are taking profits or just transferring funds to alternative addresses. Bitcoin holds on to recent gains and trades at $65,647 at the time of writing.

On the weekly timeframe, BTC gained 3.81% and 10.79% in one month.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin’s market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.