Products You May Like

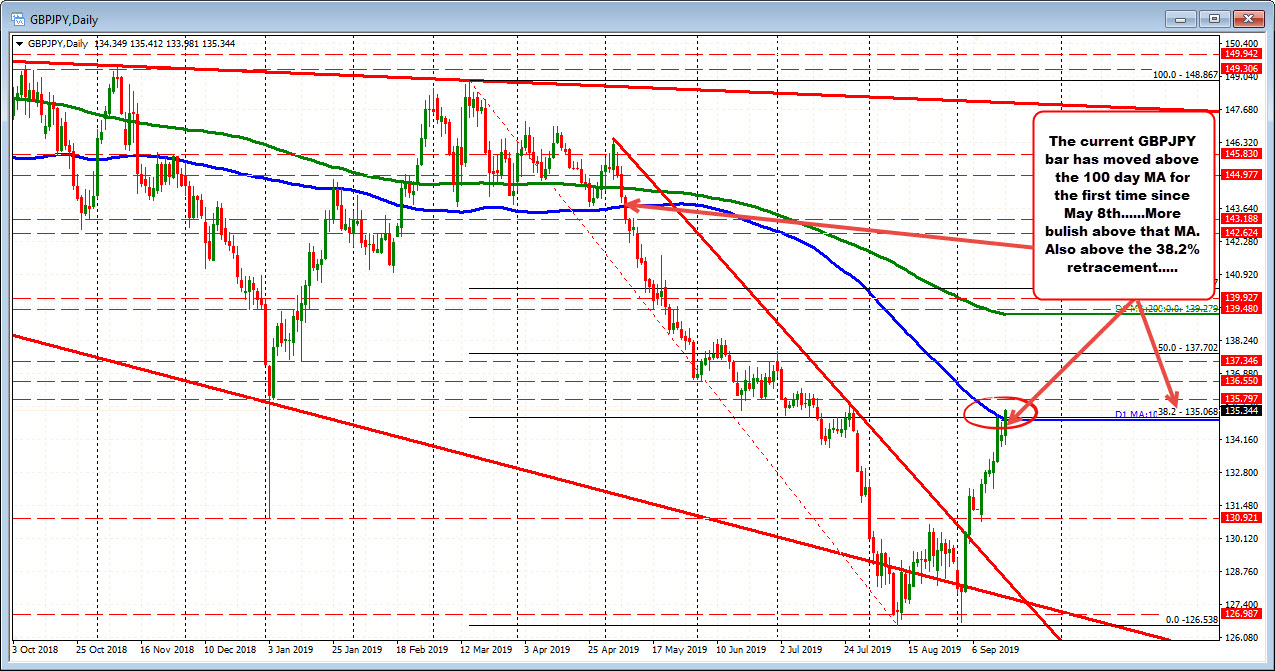

First look above the 100 day MA since May 8th

The GBPJPY is trading above it’s 100 day MA at 135.10 for the first time since May 8th. The pair is also moving above the 38.2% retracement at the same area at 135.06 area.

Staying above those technical levels are more bullish for the pair.

The next targets come out at 135.797 and then 136.55 and 137.746. The 50% of the move down from the March high comes in at 137.702 and it too would be a target on more upside momentum.

Drilling down to the hourly chart, the last few hours has seen the price finally show some momentum over the 100 day MA (see overlay on the chart below). On the downside today, the price low could not reach the 100 hour MA (lower blue line). If the break above the 100 day MA does not hold, a break back below will have traders looking toward the rising 100 hour MA at 133.942.