Products You May Like

- EUR/USD lost some considerable ground this week.

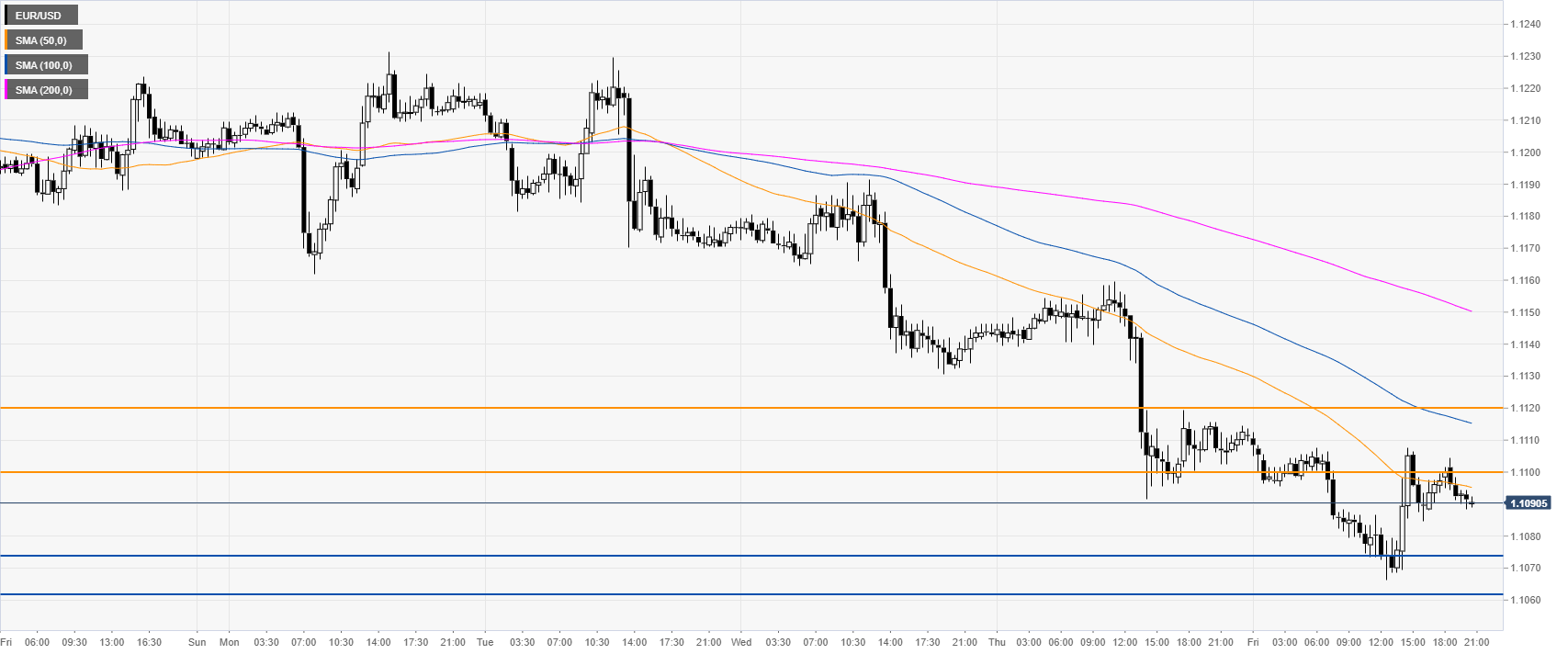

- The level to beat for bears is the 1.1074 support.

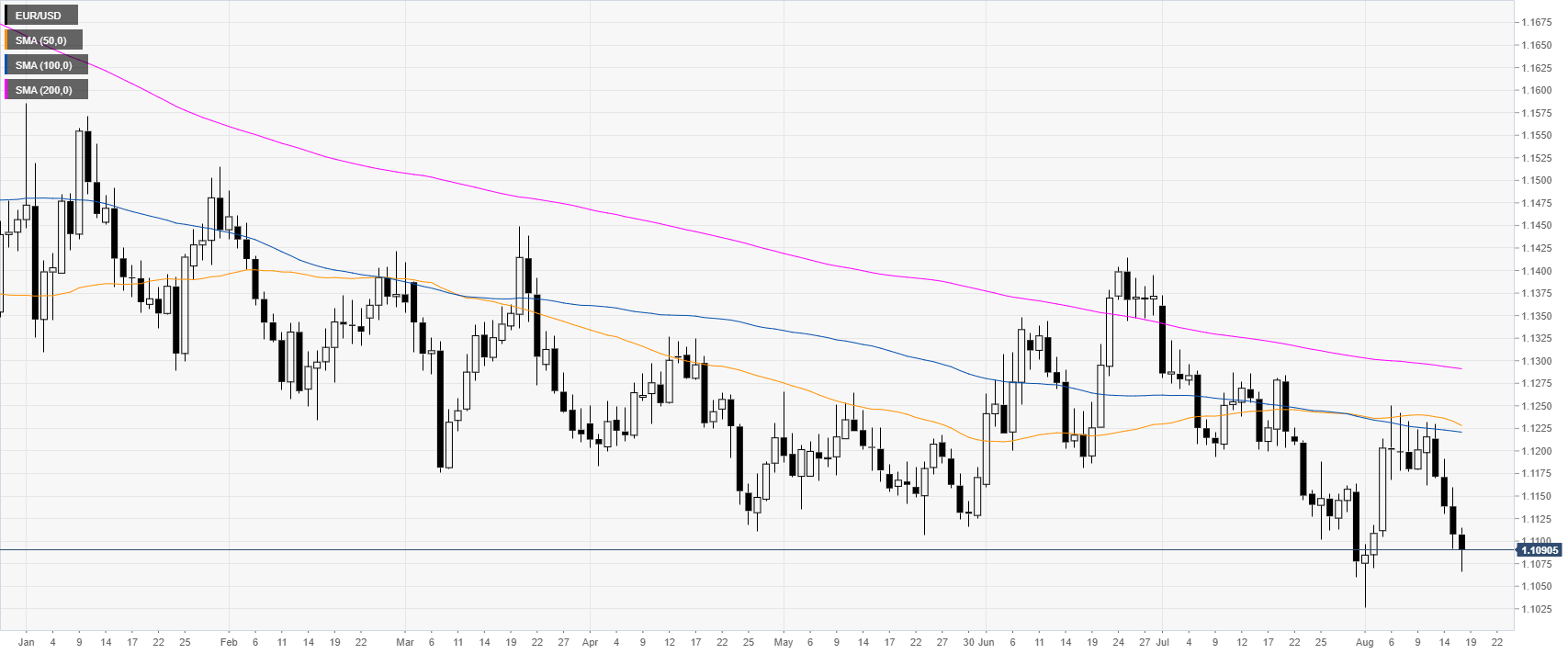

EUR/USD daily chart

On the daily time-frame, the common currency is trading in a bear trend below the main daily simple moving averages (DSMAs). The recent data in the US has kept the buck supported. Inflation and the Retail Sales Control Group were positive. Additionally, easing US-China trade tensions also support the Greenback. On the other hand, on Thursday ECB member Olli Rehn said the ECB stimulus package might overshoot expectations in September. The dovish comment was seen as bearish for the Euro. Thi Friday, US Consumer Confidence came below expectations.

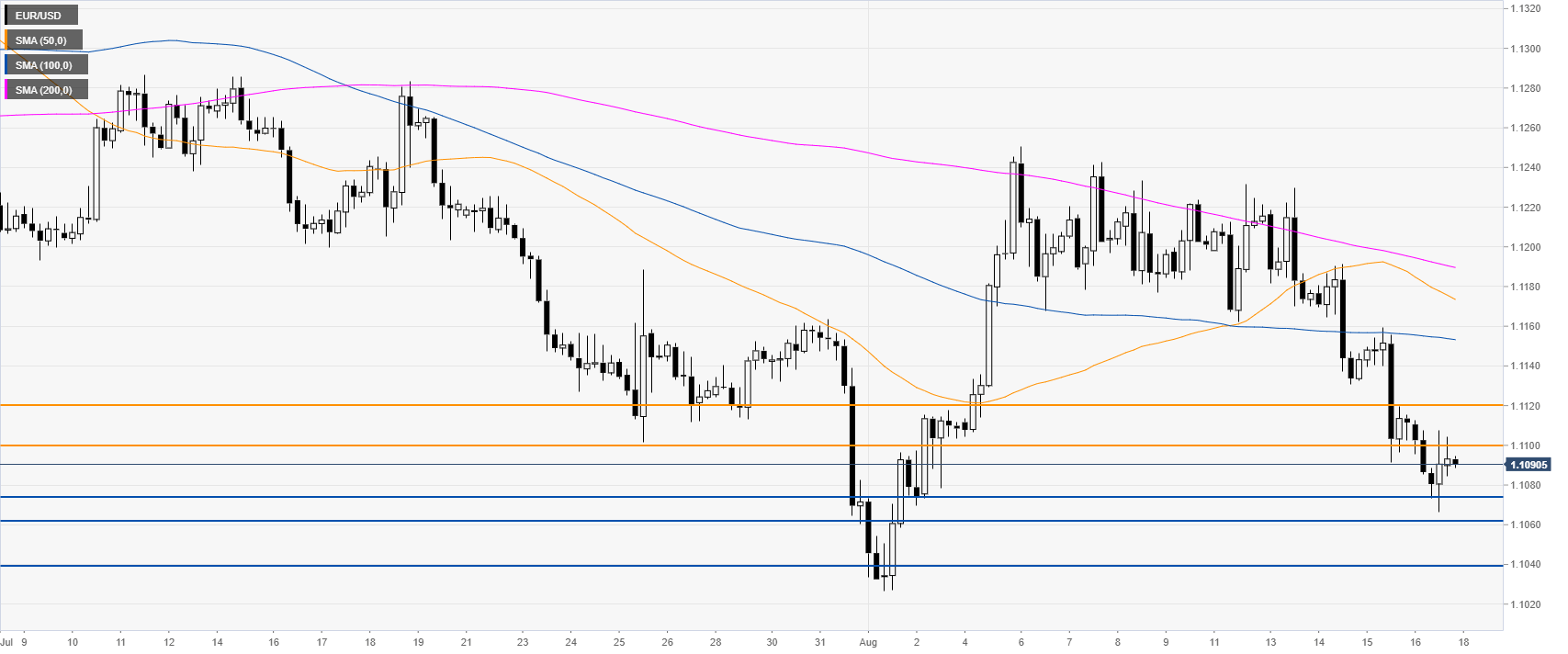

EUR/USD 4-hour chart

The Euro is trading below 1.1110 resistance and its main SMAs, suggesting a bearish bias in the medium term. Bears need a break below 1.1074 to reach the 1.1062 and 1.1039 levels.