Products You May Like

A look at safe haven assets as we brace for a period of uncertainty

Ongoing

discussions are swirling about President Trump and President Xi’s meeting at

the G20 summit In Japan. This was a high-stakes meeting with concerns about a slowdown in

global growth,

through a protracted trade war, the forefront of investors’ minds.

It

is not hard to see why this is the case since 40% of the world’s GDP comes from

the combined economies of the US and China. The meeting left many questions

unanswered, and ultimately a backpedaling from the implementation of tariffs.

However, given Trump’s volatile nature, nobody knows

if further tariffs will be threatened, making traditional safe haven assets

enticing. This article will point out some of the go to safe haven assets that

should interest you should the ongoing trade war take a turn for the worst.

Going for Gold

With

the Federal Reserve having recently signaled a rate cut in July there is now a

growing expectation of a global low interest rate landscape that could last for

some time. One of the results of this has been the growing value of Gold

against the USD.

Before

the last FOMC meeting Gold was kept underneath key weekly resistance on the

XAU/USD chart, but with the dovish shift from the Fed Gold broke out of that

level. See chart below:

The

technical breakout is clean and convincing and a downturn in the latest G20

US-China trade talks will result in further Gold buying. The downside of owning

Gold is that, unlike Bonds and Stocks, you do not get a return for holding the

asset.

So, with US equity markets at their highs and bond

yields falling across the world, Gold is once again regaining its attraction. A

US-China trade war storm will complete the fundamental picture to that

technical and result in further gold strength going forward. When investors

face very stormy markets, they like to go for Gold.

Bolting for Bonds

High

grade bonds become a place of safety in uncertain times, since they are a

better than holding cash, but they still do offer a fixed rate of return if the

blind is kept for its full term. The investing legend, Benjamin Graham,

recommended having a 50-50 split between bonds and equities and not allowing

that ratio to differ by more than a 75-25 ratio split.

In other words, in uncertain times, he recommended

having up to 75% of your portfolio in bonds. This would therefore make high

grade government bonds, like US treasuries and UK gilts, attractive in stormy

and uncertain financial.

Yearning for Yen

The

Japanese Yen is a traditional safe haven currency. Negative interest rates,

like the Bank of Japan currently has, would typically discourage currency

capital inflows. However, the debt structuring of Japan means that the currency

is considered very stable and safe for uncertain times.

As

a result, when investors and speculators are fearful, there are sudden and

marked inflows into the Japanese Yen. The pair that stands out for particular

downside in a fresh round of the ongoing US-China trade war would be the

AUD/JPY pair.

As around 30% of Australia’s economy is made up of

trade with China it stands to lose out on a US-China trade war. Further trade

strain would result in AUD weakness and JPY strength on safe haven flows.

Swinging to the Swiss franc

Another

safe haven currency that would attract safe haven flows would be the Swiss

Franc. That would see safe haven flows resulting in CHF strength. However, it

is worth bearing in mind that the Swiss National Bank (SNB) has an interest in

ensuring that the CHF does not become too strong.

As Switzerland has an export economy a strong CHF

hurts its exporters. As a result, the SNB maintains periodic intervention in

the CHF. If the CHF becomes too strong, be alert to the possibility of

intervention.

In certain times let the US Dollar Index be your guide

The Federal Reserve

is the most important central bank in the world with the US dollar being the

most traded currency in the world, comprising of around 70% of all transactions

on a given day. So, having a handle on what the Dollar is doing overall on any

given day is going to be a key advantage for any trader. The Dollar Index

will help you do just that.

The US Dollar Index is a guide for the direction of the USD in any pair

Trading any pair

with a USD half will be guided by the USD index, so here are a couple of key

facts to keep in your mind:

• If the USD is the

base currency (USD/xxx), then the US dollar Index and the currency pair will

typically move in the same direction.

• If the USD is the

quote currency. (xxx/USD) then the US dollar index and the currency pair

will typically move in opposite directions.

The US dollar index

and the smile theory.

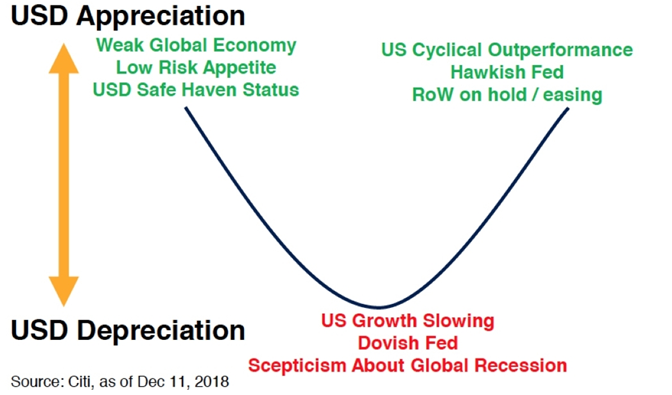

The US dollar index

can give you a quick broad picture of the dollar and help you see what is going

on with the market. The smile theory is worth mentioning since it is such a good way of expelling the three

varying ways the dollar responds to different situations. If you look at the

picture above you can see a smile.

On the left-hand

side of the smile you have USD strength, which is when the global economy is

struggling. This is where you have JPY, CHF strength and USD gains too as it

acts as a safe haven currency. The bottom part of the smile is where the USD

depreciates on a dovish Fed. At the time of writing, in June 2019, the USD is

falling with a more reserved Jerome Powell looking at a rate cut in July.

The right part of

the smile is when the USD gains value on a hawkish fed and a risk on

environment. This smile theory is useful as a quick rule of thumb for

understanding the dollars present position and what is likely to happen next.

There is normally an

inverse relationship between the value of the dollar and commodity prices. By

getting into the habit of noticing the USD index as soon as you start trading

you can speed up your analysis on the dollar and also gain invaluable insights

to inform your next trading decision.

This article was submitted by CMS Prime.