Products You May Like

A 5 part series

During this week I am in Dubai teaching a course on FX trading and I thought this would be a good time to have a series. imaginatively titled, 5 trading mistakes to avoid. So, over the course of the next 5 days there will be a short mini series covering the following five topics:

- Mistake #1 Over leveraging

- Mistake #2 Speculator’s Guilt

- Mistake #3 Not being accountable

- Mistake #4 Over trading

- Mistake #5 Revenge trading

So, today we will begin with our first lesson looking at the danger of over leveraging.

Trading Mistake #1 Over leveraging

The misuse of leverage is the single biggest killer of traders. It is intoxicating, plays to the snake-oil salesmen who want to convince you that you can be a millionaire in a month if you use it, and is readily available. However, it is also the single fastest killer of aspiring retail FX traders trading accounts and so makes it to my number 1 spot of trading mistakes to avoid.

A powerful weapon in the wrong hands

Every now and then you hear of a disaster that happens because an item of equipment is too powerful for its user. I remember reading a very sad case of a person who was firing a very powerful automatic weapon on a shooting range in the US.The re-coil from the weapon was so strong that the inexperienced person sadly ended up shooting themselves by accident. It was a tragic mistake to put such a powerful weapon in a inexperienced person’s hands without proper training. The misuse of leverage can be sometimes compared to this, a weapon that can end up destroying you. The good news is that it doesn’t have to be this way. So, some may ask, what actually is leverage?

What is leverage?

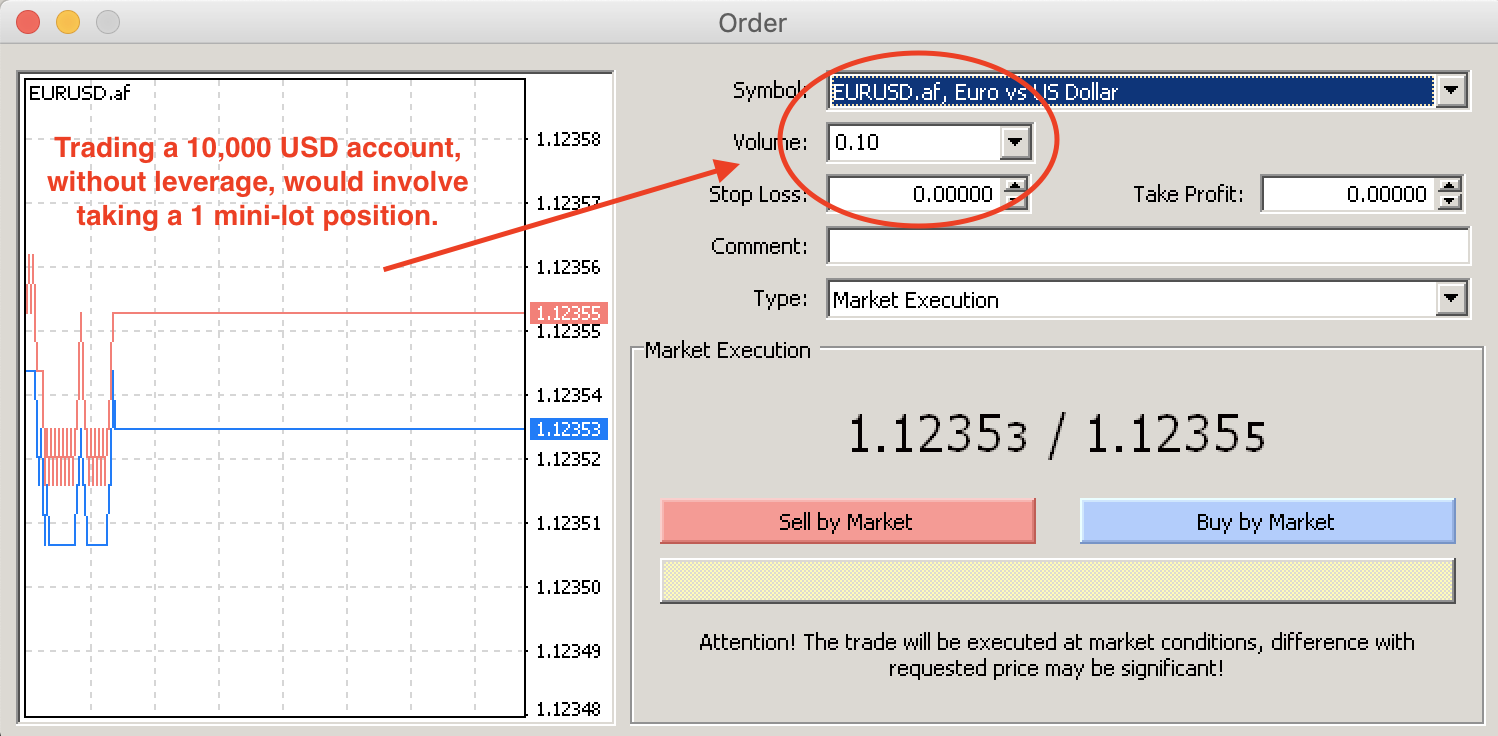

Leverage is simply the ability to trade a position sizes larger than your account size. Think of your account size vs your account size.If you have a 10,000 USD size account then trading without leverage will involve trading a lot size that is equivalent to your account size. So, if your account size is 10000 USD then trading without leverage will involve trading a mini lot of 0.10. See screenshot below for an example of a non-leveraged trade on a 10,000 USD account.

The more leverage you use, the harder it is to trade with a clear head

If you use too much leverage you will find it hard to not interfere with your trades. You will make more and more emotional decisions and experience deep, and rapid swings in your equity curve. Are you struggling with your trading at the moment? Then it may be possible that over leveraging is either causing your trading mistakes, or making them worse. Beware the danger of over leveraging. With some brokers offering leverage at levels of 1:50, 1:100 and 1:200+, the temptation to trade with borrowed money is huge. However, that leverage comes at a price and it may be the cost of your trading account if you leave it unchecked. I personally advocate trading without leverage, especially for the newbie trader, and only using a small amount of leverage in specific situations.

Tomorrow’s article will be on a lesson I learnt from a Dicken’s novel and it is titled: Mistake #2 Speculator’s Guilt.