Products You May Like

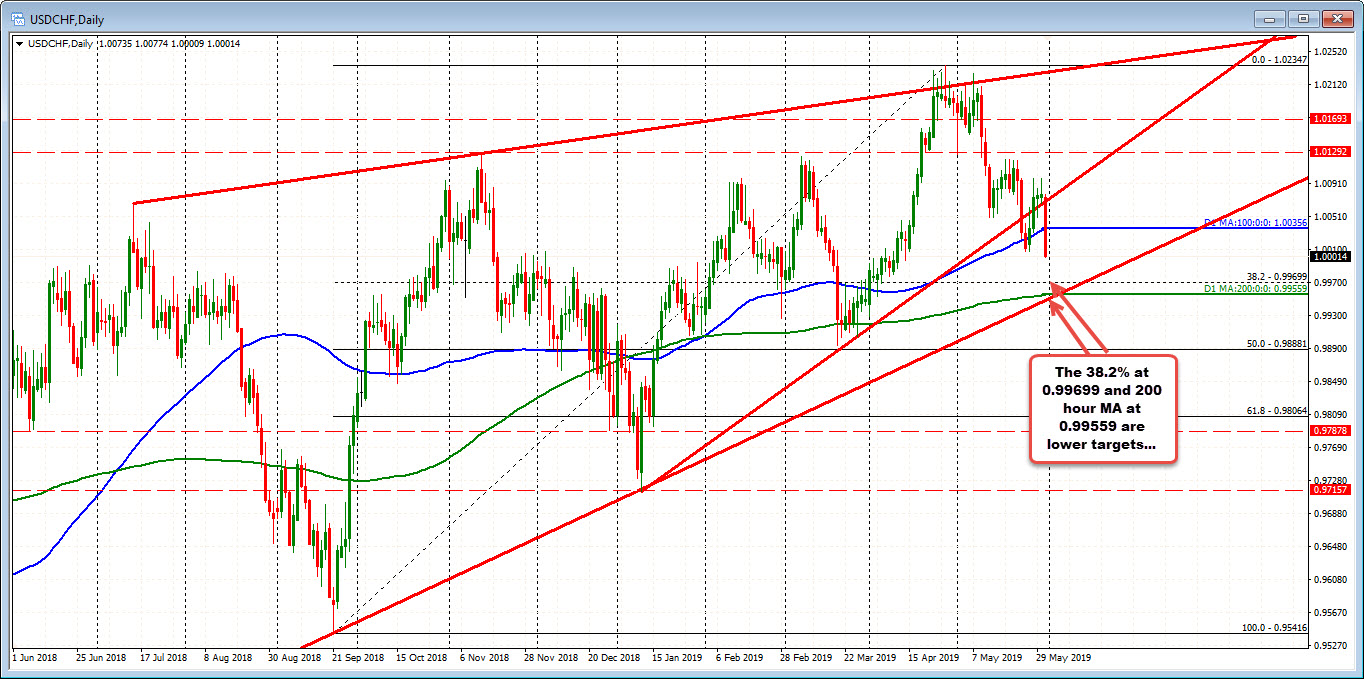

Tests the 1.0000 level

The USDCHF is trading to new session lows. The low was 1.0007 reached on May 27. The low just reached 1.00005 (a smidgen above the parity level).

On a break of the parity level, the next major targets on the daily chart come in at 0.99699 where the 38.2% of the move up from September is found. THe 200 day MA is lower at 0.99559. Today the price fell below the 100 day MA as well at 1.00356. That is a risk level for shorts from this chart.

Drilling to the hourly chart, it wasn’t buy yesteday that the price was testing a topside ceiling at 1.0097. Today the price fell below a trend line and then the 200 and 100 hour MA (green and blue lines). Staying below those MA lines, gave the sellers the technical confidence to take the pair lower. The 100 day MA did give traders cause for pause, but the last run lower has pushed away from that MA level.