Products You May Like

Forex news for North American trade on May 31, 2019:

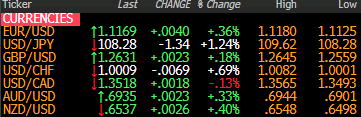

Markets:

- Gold up $17 to $1305

- WTI crude down $3.22 to $53.37

- US 10-year yields down 8.4 bps to 2.13%

- S&P 500 down 37 points to 2752

- JPY leads, CAD lags

It got ugly in the bond market after Trump announced escalating tariffs on Mexico related to the border. It was an old fashioned flight to quality with the yen and Swiss franc as the beneficiaries.

USD/JPY finished at the lows of the day in what was a steady bleed lower since rumors of the announcement started. The selling accelerated after reports said trade hawk Lighthizer was against the tariff announcement and that Stephen Miller was behind it. It’s a hint that hardliners increasingly have the President’s ear.

The euro and pound weren’t sure what to do with the news. They climbed initially then were hit by heavy selling into the London fix. However this is starting to look like more of a US problem than a European one and both currencies rebounded to finish near the best levels of the day.

The problem for the dollar is that bonds are now screaming for rate cuts. US 2-year yields looked like a capitulation trade as they sank 14 basis points to 1.92%. In turn, that was a big boost for gold and other safe assets.

The Canadian dollar wasn’t greatly affected by the GDP report. It was soft because of revisions to Jan-Feb but March was strong and forward-looking indications were solid. USD/CAD fell to 13516 from as high as 1.3565, which was a five-month high.

Rest up and get ready for another busy week. Have a great weekend.