Products You May Like

CRUDE OIL & GOLD TALKING POINTS:

- Crude oil prices rise amid talk of further US sanctions on Venezuela

- Gold prices shrug off US Dollar gains to rise as Treasury yields drop

- US-China trade talks may overshadow FOMC rate decision, US GDP

A lull in top-tier relevant event risk and a deluge of incoming developments translated into uneven performance for benchmark commodities. Gold prices rose – shrugging off a modestly stronger US Dollar – as Treasury bond yields declined despite the absence of a clear lead from sentiment trends.

Crude oil prices jumped after US Treasury Secretary Steve Mnuchin said in an interview with Bloomberg that further sanctions on Venezuela are being considered. That appeared to amplify supply concerns touched off by political turmoil amid dueling claims on the country’s presidency.

FOMC AND US GDP DUE, US-CHINA TRADE TALKS MAY PROVE PIVOTAL

An action-packed session in the hours ahead features a first look at fourth-quarter US GDP data as well as an FOMC policy announcement and press conference with Chair Powell. Traders are also eyeing soundbites from the sidelines of US-China trade talks as Vice Premier Liu He visits Washington DC.

PMI survey data endorses the idea that growth slowed in the last three months of 2018 but outperformance relative to forecasts hints it may moderate less than economists envision. As for the Fed, it may cite the recent disruption in data flow courtesy of the US government shutdown to justify a status-quo stance.

If so, positive cues for market sentiment from a modestly upbeat GDP print might be offset as investors interpret the Fed’s reluctance to consider dialing back quantitative tightening (QT) as mildly hawkish. On balance, that leaves the trade talks as the tipping factor sentiment trends.

Mr Mnuchin also said he expects meetings with Chinese delegation to yield “significant progress”. That echoes hopeful comments from the Trump administration’s top economic adviser Larry Kudlow but clashes with remarks from Commerce Secretary Ross, who said the two countries are “miles and miles” apart.

For their part, investors will want to see concrete steps toward de-escalation. If what they see instead are vague pronouncements couched in empty niceties, a sense of disappointment might emerge. That would bode ill for risk-geared crude oil.

The outlook for gold appears to be rather more clouded. A risk-off scenario has scope to pressure yields lower but US Dollar gains encouraged by both the Fed and any renewed safety-seeking liquidity demand might derail upward follow-through.

See our guide to learn about the long-term forces driving crude oil prices!

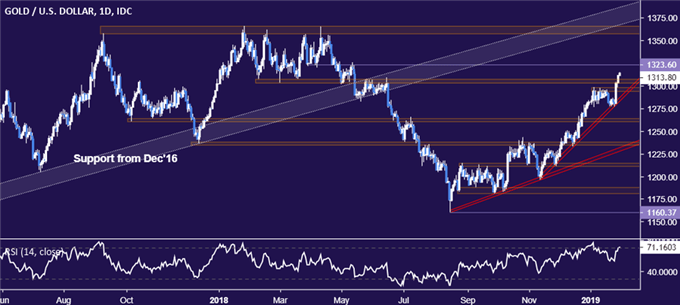

GOLD TECHNICAL ANALYSIS

Gold prices pushed past resistance in the 1302.97-07.32, opening the door for a test of the chart inflection point at 1323.60 next. Moving further above that puts the pivotal double top in the 1357.50-66.06 zone back in focus. Alternatively, a turn back below rising trend support at 1283.32 sets the stage to revisit the 1260.80-63.76 region.

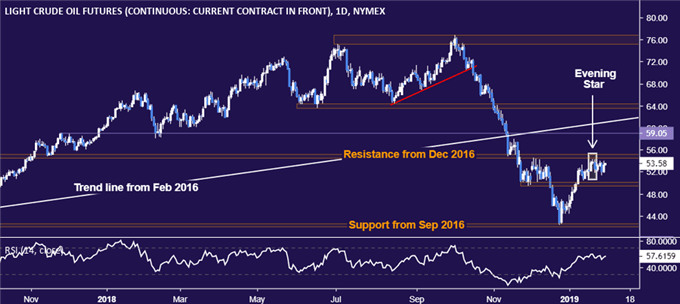

CRUDE OIL TECHNICAL ANALYSIS

Crude oil prices are struggling to find lasting momentum, but a bearish Evening Star candlestick pattern continues to suggest a top may be in the making. Breaking below support in the 49.41-50.15 area paves the way for a challenge of the 42.05-55 zone. Alternatively, move above resistance in the 54.51-55.24 region targets the chart inflection point at 59.05.

COMMODITY TRADING RESOURCES

— Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter