Products You May Like

Gold is always a great way to start the year

One of the best seasonal trends in any market is already under way. I’ve written about it year after year after year and it keeps delivering.

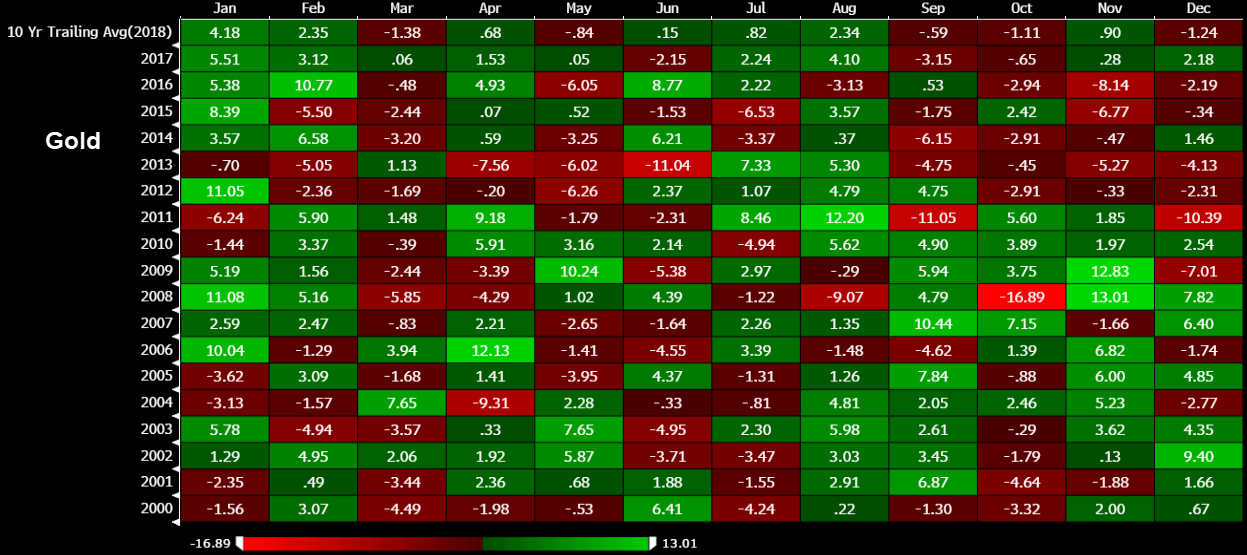

There is a major tailwind for gold early in the year, likely due to buying ahead of lunar new year holidays in much of the world. If you look over the past 12 years, the Jan-Feb period has only had negative returns once, in 2013.

The average gain over the past decade has been 4.18% in January and 2.35% in February. I’ve been writing about this trend in gold for years and recently noted that it seems to be creeping forward, with buying taking place in December.

That was true this year as gold climbed 4.8% in the month. The earlier buying could be front-running the seasonal trend. Gold also climbed 3.3% last December and continued higher through January before pulling back in February.